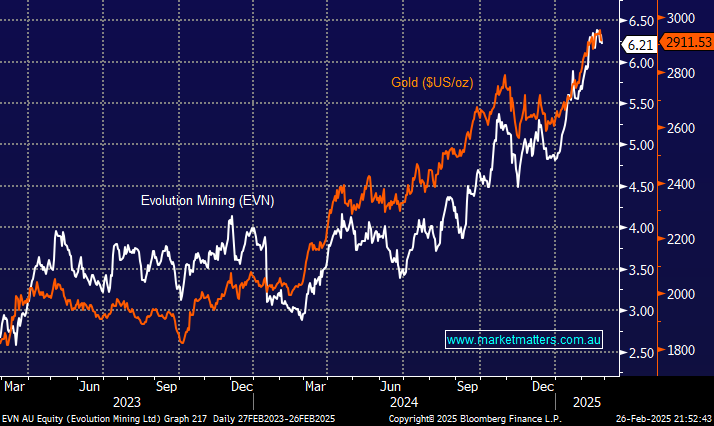

EVN slipped 1.7% on Thursday in a generally weaker session for the gold space. The last few weeks have seen some reversion across different asset classes, from banks to Bitcoin and gold. We aren’t bearish from current levels, but we believe the “easy money” short term for the bulls is in the rearview mirror, i.e. we are more likely to fade new highs in the sector instead of adding to our holdings, such as EVN.

Gold ETFs saw record high inflows last week, worth about $US4.5 billion, with around half of the inflow occurring during Friday’s stock market sell-off, according to recent JPMorgan data. Gold traditionally thrives on uncertainty, and Trump 2.0 is delivering that in spades; however, our concern at MM is amid all of this buying and uncertainty, gold is running out of steam on the upside, posing the question as to whether professionals are now selling into retail investors who are wading into ETFs.

- We have been targeting new highs for Gold, around $US3,000. The precious metal has recently traded very close to this psychological target—MM is long EVN in its Active Growth Portfolio.