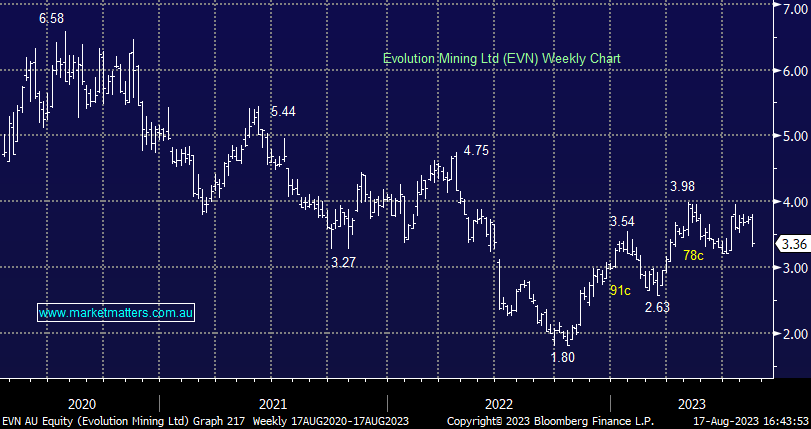

EVN -4.82%: FY23 report out for the gold miner today, its shares underperformed peers which were also weaker as gold traded below $US1,900/oz for the first time since March. EBITDA of $844m was ~5% below expectations with costs and lower copper credits biting. They left guidance largely unchanged, expecting cost per ounce to fall on higher production and the benefit of their copper production offsetting higher labour costs which are expected to climb ~6% in FY24. We still see EVN as a great way to get exposure to gold with the added copper kicker also supported by our medium-term view on the commodity.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is long and bullish EVN

Add To Hit List

In these Portfolios

Related Q&A

Gold Stocks

Gold Stocks

Gold miners

GOLD

Gold vs EVN and NST

MM’s preferred gold stocks?

Silver and gold movements

Can MM see Evolution (EVN) as a takeover target?

Thoughts on Evolution (EVN) SPP

Potential escalation between Israel and Hezbollah

Does MM like SLR, NST and Gold into previous metals weakness?

Where would MM buy Evolution Mining (EVN)?

Does MM like buying gold stocks in weakness?

Thoughts on the 2nd tier gold shares please

How much upside does MM see in the likes of EVN?

Does MM like Gold Stocks For Income?

What are MM’s thoughts on gold stocks EVN & NST?

Does MM prefer RRL or EVN for gold exposure?

Is the rise in Gold sustainable?

MM thoughts on Evolution Mining (EVN) SPP

Question on EVN & A2M

OGC

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.