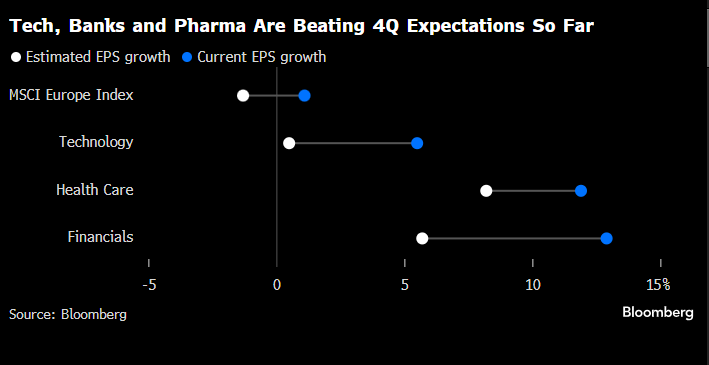

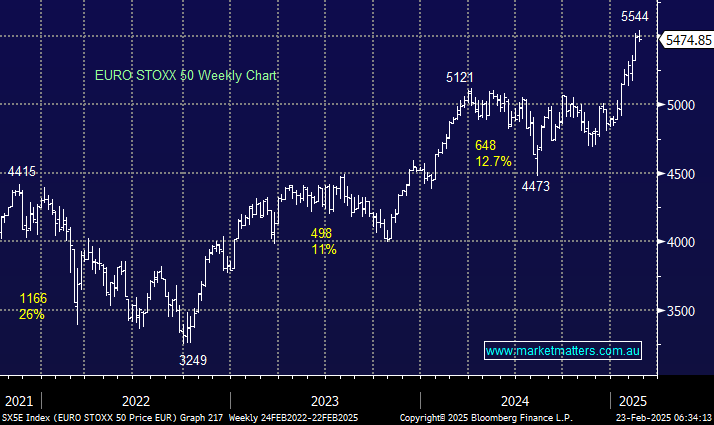

European indices have surged to new highs in 2025, with the STOXX 50 up +11.8% year-to-date compared to the S&P500, up just +2.2%. The region’s tech sector rarely gets a mention, sitting in the shadow of the “Magnificent Seven”, but they are exceeding expectations this quarter, joining financial and healthcare companies as one of the reporting season’s best-performing segments. Buoyed by artificial intelligence (AI) demand, the technology sub-sector in the MSCI Europe index averaged earnings growth of 5.5% in the fourth quarter, significantly ahead of pre-season estimates of 0.5%. With ~70% of European companies having reported EPS Growth (earnings per share), things are looking healthy across these influential sectors.

- As we often say, earnings drive share prices; hence, it should be no surprise that European indices are outperforming their US peers.

With analysts revising European Tech estimates higher for 2025, after missing the turnaround following a tough 2024, we can see plenty of support for European stocks into dips.

European stocks posted new highs last week, although Friday’s weakness across US bourses is likely to see a dip early this week. Last year, performance elastic bands stretched further than many people thought likely; that characteristic could well be repeated in 2025, with European equities likely to be bought into weakness as money switches out of the US into the region.

- We remain bullish on European indices, advocating buying into dips, with one potentially starting this week.

- However, we remain comfortable with our call that European indices will continue to outperform the US this year.