- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

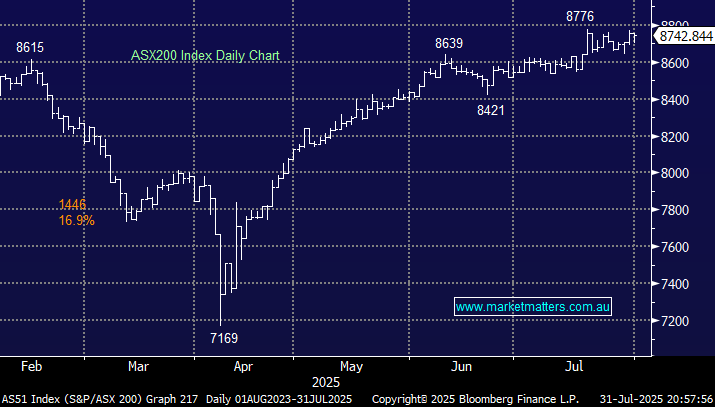

The ASX 200 ended the Thursday session down just 0.2%, recovering ~80% of its early decline, with winners and losers evenly matched. July lived up to its seasonal reputation, closing up +2.4%. If not for a -2.6% clobbering of the influential Materials Sector yesterday, we could easily have been trading at new highs. We will look at the copper narrative later in today’s report, but we don’t expect to turn on our screens in the morning to see Comex Copper down almost 20%; it’s never happened since the contract began in 1988. The tariff shenanigans haven’t gone; even if global markets are making new all-time highs, their impact is becoming more targeted. The local stocks with exposure to copper didn’t perform too badly, being more exposed to London LME Copper, which has experienced a more muted decline in the last 48 hours:

- Sandfire (SFR) -4.2%, RIO Tinto (RIO) -3.6%, Capstone Copper (CSC) -3.4%, Evolution Mining (EVN) -3%, and BHP Group (BHP -2.4%.

Conversely, the tech sector was best on ground, advancing +1.3% following the stellar results from Meta and Microsoft after the US close – the S&P 500 futures were trading ~1% higher when we closed at 4 pm AEST. However, it wasn’t enough to offset the bearish sentiment washing through the miners on the day, although they have outperformed for the month. Most ASX pockets of the market are still enjoying the “Goldilocks” backdrop with three rate cuts expected by the RBA over the next 6 months. At the same time, as we saw yesterday, the local economic engine is ticking away nicely with building approvals and retail sales for June both coming in well ahead of expectations. The market should continue to flourish with such a healthy tailwind.

Overseas markets disappointed overnight after promising so much following the after-market earnings reports. In Europe, the EURO STOXX 50 fell 1.4% while the UK FTSE fared better, only slipping 0.1%. In the US, the S&P 500 reversed lower to end the session down 0.4%, and the tech-based NASDAQ ended down 0.6% even with Meta surging +11.3%, ably supported by Microsoft, which finished +4%.

- The SPI Futures are calling the ASX200 to open down 0.7% this morning following the reversal lower overnight by US indices – BHP Group (BHP) was trading ~20c higher in the US.