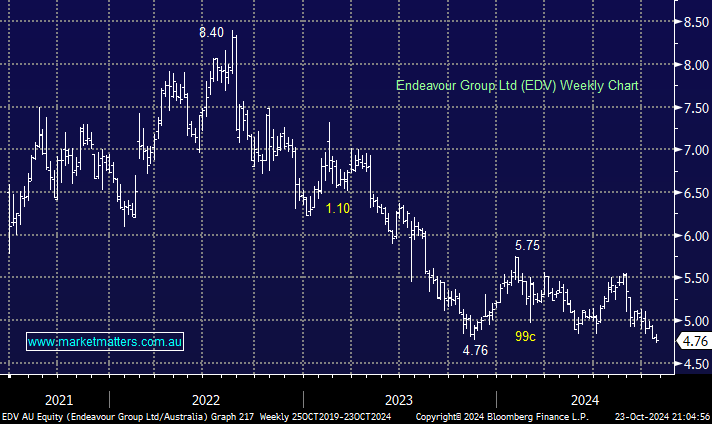

Pub and bottle shop business EDV is well positioned in the liquor market with Dan Murphy’s and BWS, but the stocks struggles over recent years hasn’t been helped by the news in September that the drinks giant’s CEO, Steve Donohue, was stepping down from the role after 30 years with the business – we don’t regard fresh eyes as an issue with a company that’s seen its share price almost halve in 2-years. The stocks forecast to yield 4.7% over the next 12-months, increasing to 5.36% in 2027 which is one the reasons Goldman has it as a buy, targeting a 30% upside in the price. We share their more positive outlook on the business, but believe there’s a good chance of a washout on the downside first, with our ideal entry now only 5% away.

- We wrote in June that we may consider EDV as a contrarian play ~$4.50, this hasn’t changed as its valuation becomes increasingly attractive.