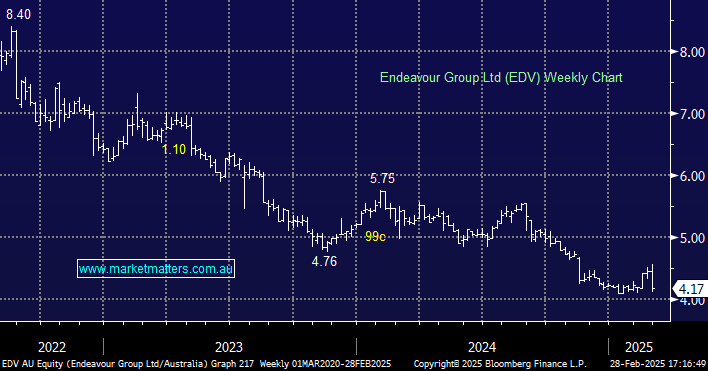

EDV -7.13%: Posted results slightly below expectations for 1H25 and echoed what we saw in Coles result yesterday which is a decline in liquor sales across retail with the market zeroing in on 2H sales momentum as a key indicator of performance.

- Sales A$6.62 billion, -0.7% yoy, estimate A$6.65 billion

- Retail sales A$5.50 billion, -1.5% yoy, estimate A$5.51 billion

- Ebit A$595.0 million, -10% yoy, estimate A$610.2 million

Sales in the first 7 weeks of 3Q25 fell -2.6% for the Retail business and contracted -2.7% in 2Q25. In contrast, the Hotels business rose 4.7% in the same period. A somewhat surprising statistic if you’ve been out and seen the price of a drink recently… considering we are all meant to be buckling down in higher interest rates and doing it tough!

On a positive note, management cut capex guidance from $450-$500 million to $375-$375 million for FY25 though the market ignored that and sold the stock based on the sales outlook.