EML -10.55%: the embattled payments company took another hit today, disclosing that it had detected fraudulent transactions from its direct debit processing business. The European segment discovered a number of fraudulent merchants taking part in $7.9 worth of transactions through August. Steps to recover a portion of the money have been taken which may reduce losses however it is another stain on the business already struggling with compliance. The full potential loss is around 25% of FY22 earnings.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

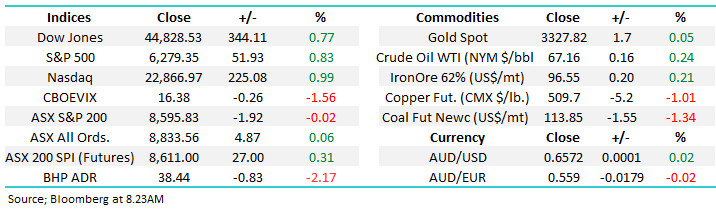

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM is neutral EML

Add To Hit List

Related Q&A

What are your current thoughts on EML

Cutting losses in the Emerging Portfolio

Does MM believe EML is a buy?

Is MM considering EML at the moment?

Thoughts on Emeco (EHL) & Service Stream (SSM) please

Why did MM hold EML so long?

Does MM see merit in “Averaging Down”?

Does MM see trading Opportunities in ELO, EML or TYR?

MM thoughts on A2 Milk (A2M) & EML Payments (EML)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

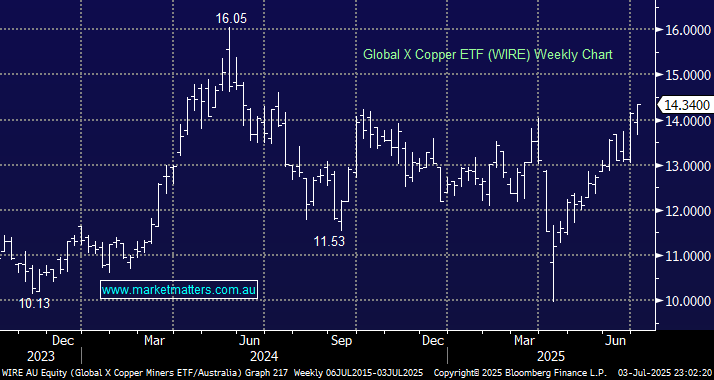

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.