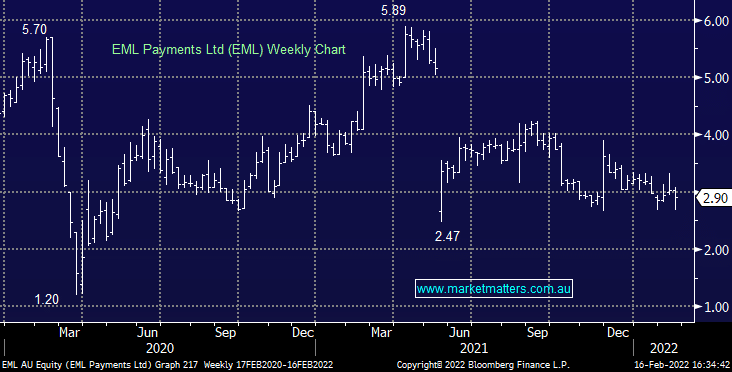

EML -3.97%: a choppy ride for the payment solutions business today on the back of a mixed 1st half result. Revenue of $113m was a slight miss, EBITDA fell 4% to $26.9m but they maintained full year guidance of $58-65m in EBITDA which will require a big second half to reach. The positive news is that the sales pipeline is growing, up 30% in the half to $13.6b and they are starting to see more establishment fees coming through. They are also leveraged to higher interest rates – for every 1% hike across all jurisdictions, EML expects to add $14-15m to EBITDA and while this is unlikely to come through near term it does provide ‘free’ growth over the medium term if and when central banks move. Shares recovered strongly off the lows today. Guidance doesn’t look too far out of reach but I suspect many analysts will take a conservative view for now.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM remains long EML in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

What are your current thoughts on EML

Cutting losses in the Emerging Portfolio

Does MM believe EML is a buy?

Is MM considering EML at the moment?

Thoughts on Emeco (EHL) & Service Stream (SSM) please

Why did MM hold EML so long?

Does MM see merit in “Averaging Down”?

Does MM see trading Opportunities in ELO, EML or TYR?

MM thoughts on A2 Milk (A2M) & EML Payments (EML)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.