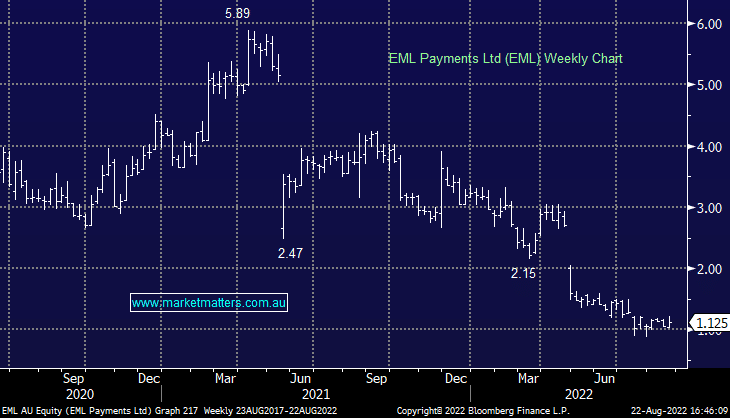

EML +6.13%: FY22 results today showed better than expected top-line growth but a challenging year from a remediation/cost perspective. This is not a bad result given ~60% of their business is in Europe, which is experiencing some big macro headwinds. Revenue from ordinary activities came in at $232.4m, a touch ahead of $230.5m expected while underlying EBITDA of $51.2m was a beat to $48m consensus. They launched a relatively small on-market share buy-back program of up to $20 million and said cash was sitting at $73.7m. The question being, has peak pessimism past for EML and is there more corporate interest out there – we suspect there is.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

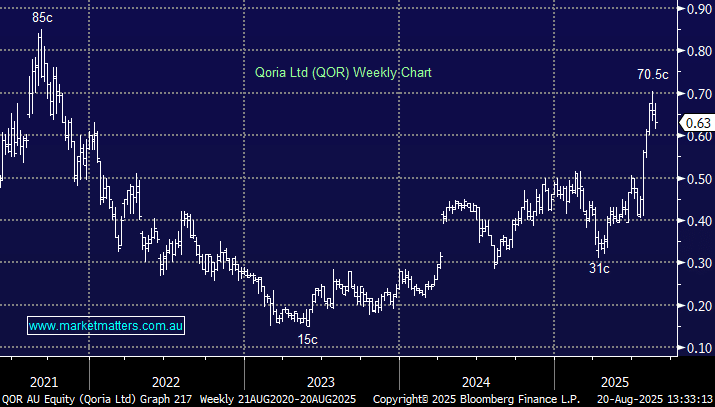

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

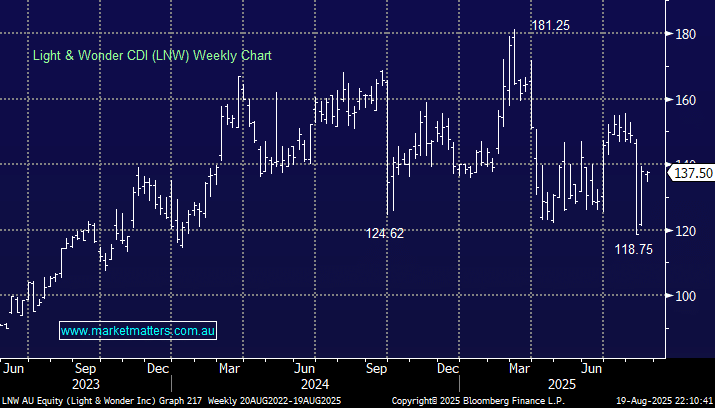

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Close

Close

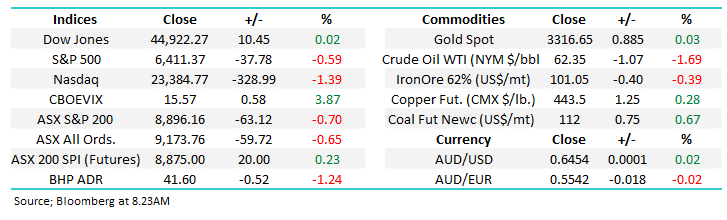

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Close

Close

MM is looking for further corporate interest in EML

Add To Hit List

Related Q&A

What are your current thoughts on EML

Cutting losses in the Emerging Portfolio

Does MM believe EML is a buy?

Is MM considering EML at the moment?

Thoughts on Emeco (EHL) & Service Stream (SSM) please

Why did MM hold EML so long?

Does MM see merit in “Averaging Down”?

Does MM see trading Opportunities in ELO, EML or TYR?

MM thoughts on A2 Milk (A2M) & EML Payments (EML)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.