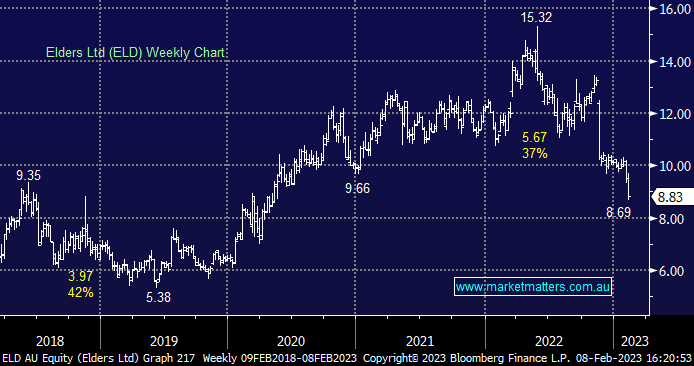

ELD –5.86%: been a shocker of late with shares nearly halving in price at a time when agricultural businesses in Australia are meant to be killing it. In our opinion, we think it’s this disconnect between the market’s perception of their operational performance and what they’ve (now) been telling brokers in recent meetings (they have had a few this week). Market perception is that Ag is very strong, and ELD is leveraged to that strength, a view that was being pushed by their Chairman at the end of last year, however, they’re now suggesting some weak undercurrents are at play, with potential margin pressure in generic crop protection commodities which may impact near-term earnings & livestock prices off 10-15%. When the market is bullish and long a stock and there is a shift in tone from the company, selling can be quiet aggressive, which is what we’ve seen in recent sessions.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

We are starting to see value <$9.00 but remain in no rush to buy this falling knife.

Add To Hit List

Related Q&A

Elders

Elders (ELD)

Does MM believe Elders (ELD) has seen a bottom?

Have Elders (ELD) shares hit the bottom?

MM’s thoughts on Elders (ELD) please

Which does MM prefer ELD or GNC?

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.