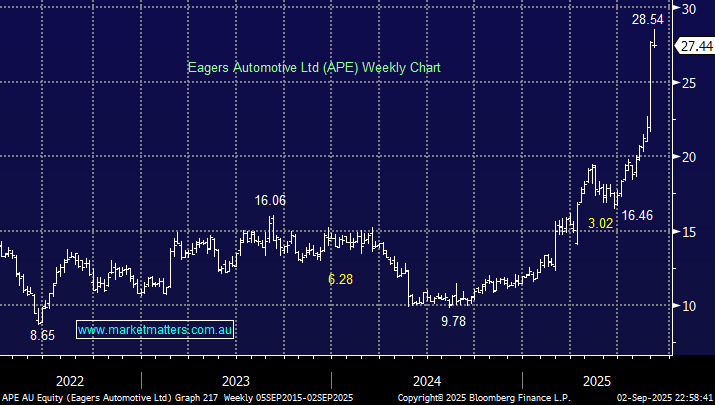

When we decide to move back up the risk curve, we will look towards August’s top performers, and APE certainly fits that bill, having surged more than 40% last month. The obvious question is, have we missed the boat with this effective car yard trading on 33x? The vehicle dealer surged last week after reporting 1H revenue that surpassed expectations, leading to beats on the EBITDA and Profit lines: revenue of $6.50 billion beat expectations by +8.7%, although we note margins were slightly lower. Also, the company said it is expecting further revenue growth supported by improving market conditions and profitable growth in its online trading platform, easyauto123.

- APE intends to continue its on-market buyback of up to 10% of its issued capital for an additional 12 months, further supporting the share price.

The BYD boom was the key driver of APE’s spike in profit and overall optimism, with the numbers certainly exciting as EV adoption becomes increasingly more affordable to the average Australian:

- In 2025, EVs in Australia are expected to reach roughly 130,000 units, making up around 11% of all new car sales – this is feeling conservative to us.

- In June, EV sales hit nearly ~16% of total sales, with BYD making up about one-quarter of EV sales and over 6% of total new vehicle sales.

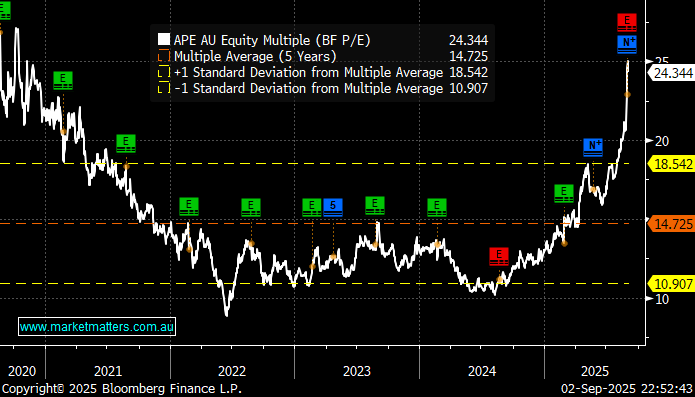

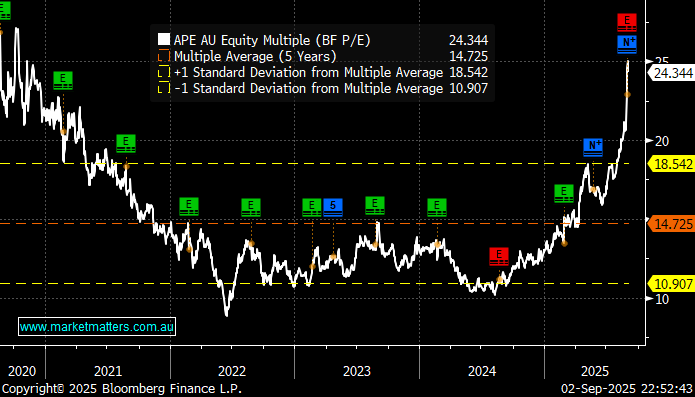

With 23 Chinese EV brands already for sale in Australia or having confirmed launch plans, plus another five likely to arrive soon, this chapter of the EV transition feels like it’s in its infancy. APE is in a strong position to benefit from an industry undergoing generational change. However, while APE is well-positioned and already executing well, the pivotal question is what’s a fair price for APE, especially now its forecasted 12-month yield has fallen to ~3% after the stock’s surge to new highs.

- We are cognisant that APE’s price reflects a lot of “good news”, with the stock trading significantly above its average historical valuation.

Rising EV adoption boosts Eagers’ unit volumes, average revenue per vehicle, financing opportunities, and used-car market potential. While service revenue per EV is lower, the overall top-line uplift from higher sales values and market expansion outweighs that. Eagers represents multiple global brands (Toyota, BYD, Kia, Hyundai, etc.) that are rapidly expanding EV line-ups, adding future scale across the board. Plus, as more new EVs are sold, the pool of second-hand EVs expands, creating new resale and trade-in opportunities. APE’s significant presence via easyauto123 and other channels is likely to reap rewards in the secondary market.

Similar to the market, we like APE’s position over the coming years. However, it’s extremely hard to weigh APE’s future growth potential, with the share price already factoring in significant EV adoption over the coming years and subsequent revenue lift for APE. This is a classic case of “buying the dip” if it occurs. We do like APE into a dip, but we haven’t added the stock to our Hitlist because any slight disappointment is likely to be painful on the share price.

We like the risk/reward towards APE if it consolidates back towards $25, but this would be a fairly aggressive position.