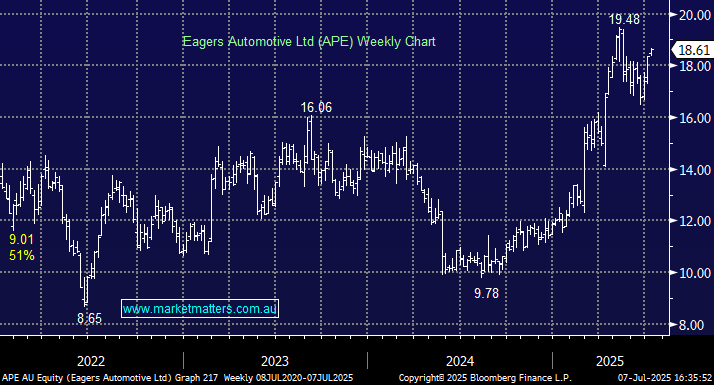

APE rerated on the upside in February after the new and used car retailer reported FY24 revenue up 14% as they enjoyed surprisingly strong demand for new vehicles. Importantly, margins were better in the 2H on strong sales of new cars, while guidance was exceptional, expecting around 9% revenue growth in FY26. For good measure, the company has extended its buyback for 12 more months, starting on the 1st of July, for up to 10% of the issued share capital. APE has navigated a tough time extremely well, and with rate cuts flowing through, we can see new highs in the coming months.

- We can see APE testing the $20 area in the coming months.