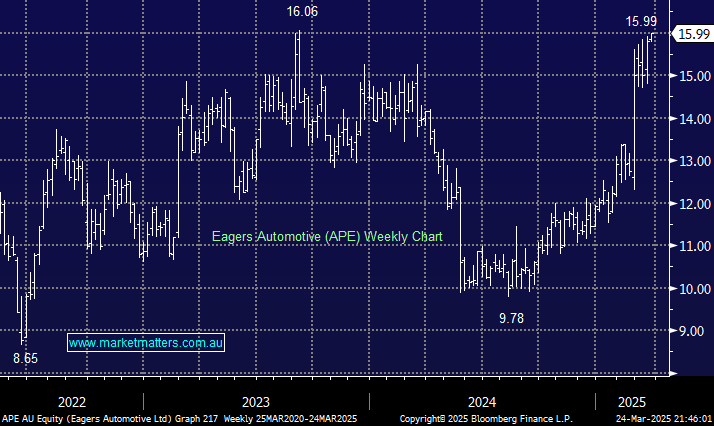

APE gained another +1.2% on Monday, bringing its year-to-date gain to +35%, a notable result in a market currently in negative territory. The new and used car retailer has been on fire since it beat benign earnings expectations in February. Data on car sales had been weak in the 2H of calendar 2024 which implied a tougher result from APE was likely, but that failed to materialise and with investor sentiment and positioning on the bearish side, the stock has rallied strongly.

Margins are expected to improve further in the second half of 2025, driven by resilience in new car sales, while revenue growth expectations have been upgraded to around 9% in FY26. However, the question now is whether the stock has gone too far, too fast.

On an Est PE of 15.5x, APE is now back to around average valuation, having been on 10x when sentiment was weak. Still a reasonable valuation considering the company’s strong performance in a challenging environment. With EV and Hybrid adoption set to experience another wave of buying (we think), APE looks well-positioned to benefit. Plus, a forecasted 4.7% fully-franked yield over the next 12 months adds some cream to the cake.

- We can see a pullback towards $15 but prefer to adopt a “buy the dip” approach toward APE.