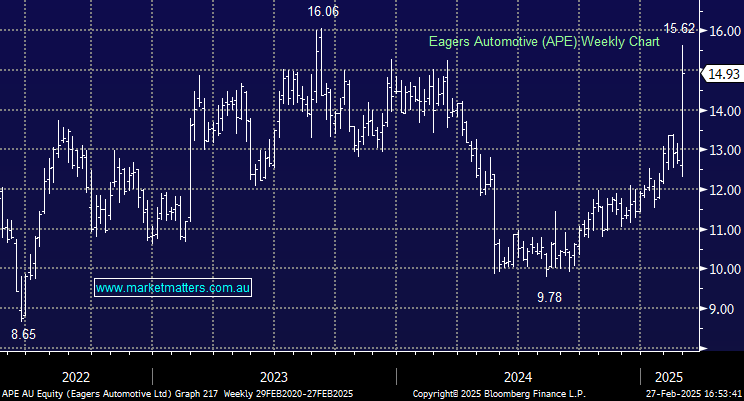

APE +19.92%: Had a great session after the new and used car retailer reported FY24 revenue up 14% and said there is strong demand for new vehicles.

- FY24 Revenue of $11.19 billion, up +14% y/y and ahead $11.11 billion consensus

- Underlying net profit of $252.8m, around 7% ahead of consensus.

- Final dividend per share $0.50, flat on the year.

Margins were better in the 2H on strong sales of new cars which was impressive relative to the conditions playing out in the car market more broadly, a theme we wrote about here a few weeks ago in the context of Smart Group (SIQ).

In terms of guidance, they said we should expect around 9% revenue growth in FY26 which is well ahead of market expectations, which sat at ~4% growth.

- Clearly the market (including MM) was concerned about the new car market, however, we’ve now had above consensus results from car parts sellers, lease providers and car retailers which all paint a better picture than feared.