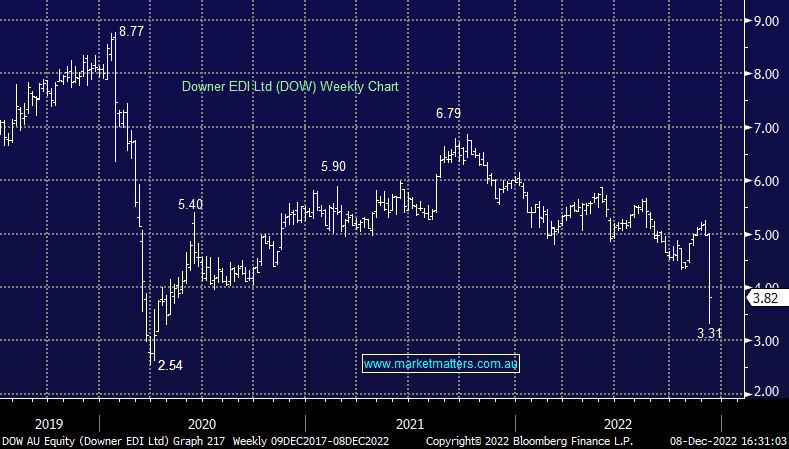

DOW -20.42%: The contractor came clean this morning about an accounting issue, having incorrectly recognised revenue from a long-term, maintenance contract to the tune of $40m. As a result, they cut FY earnings guidance by $8-10m and had to explain away issues with their internal systems that led to the embarrassing mess. While it will have no cash impact as it’s just early recognition of revenue that will eventually be completed and paid for, it’s a really bad look + it shows the chasm between reported profit and actual cash. In any case, the share price decline of ~30% was an overreaction this morning with the stock closing ~10% up from the lows.

scroll

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has no interest in DOW, not just a result of today’s debacle

Add To Hit List

Related Q&A

Does MM like DOW & / or JLG?

Finding infrastructure exposure

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.