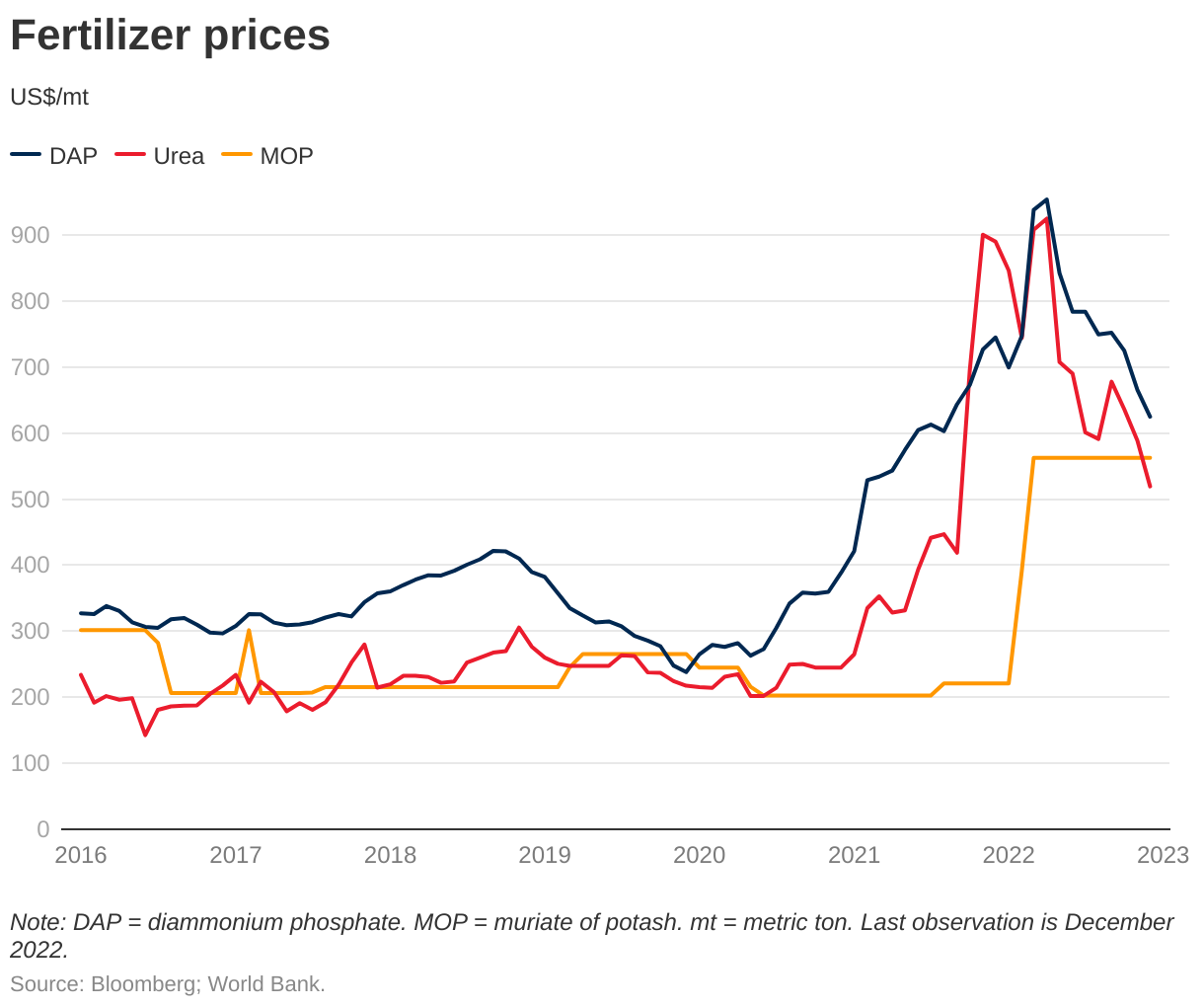

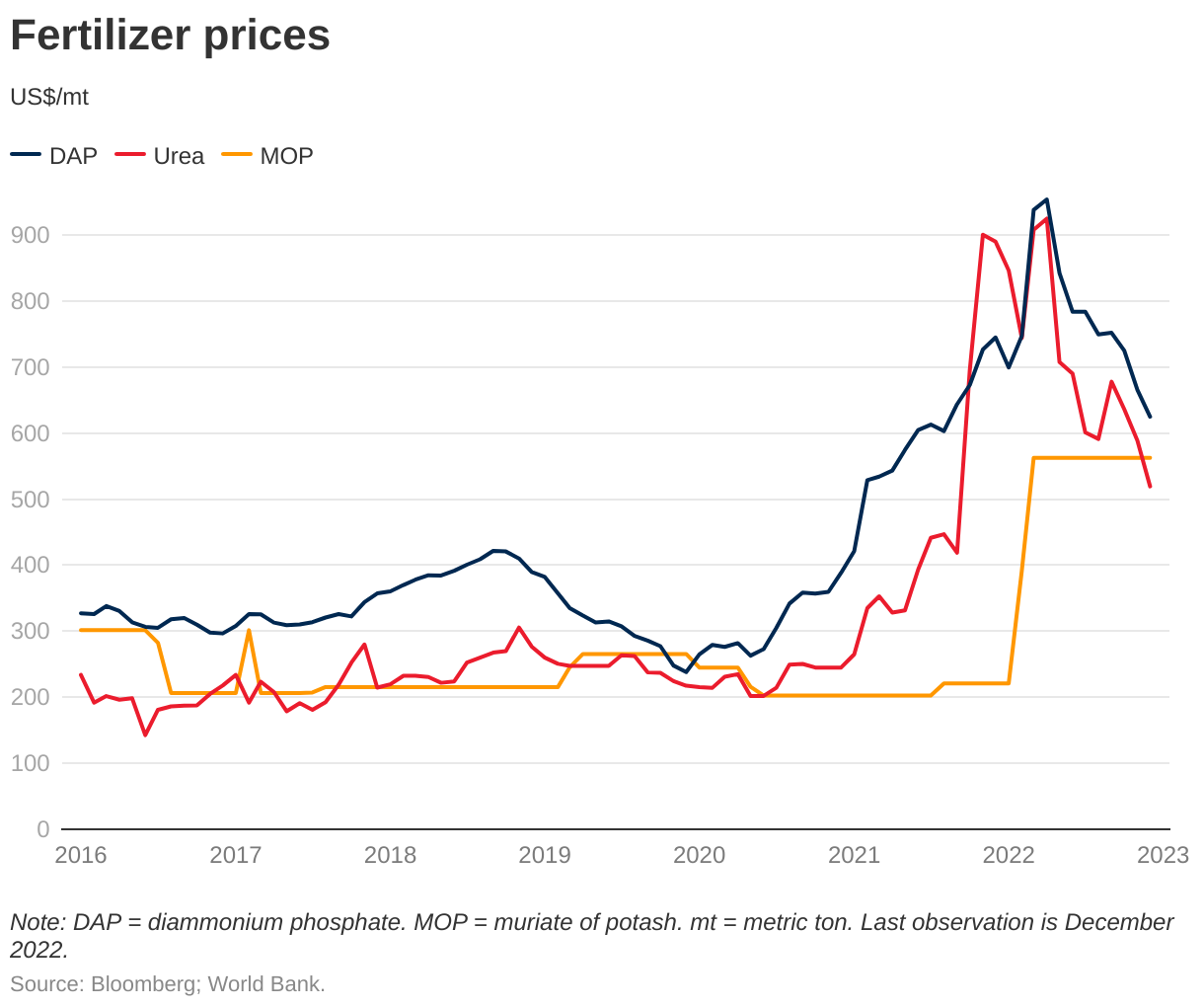

Yesterday, BHP announced they were on track to invest another $7.7bn into the second stage of its mammoth potash project based in Canada. The investment is set to double production, making its Jansen potash project one of the world’s largest mines – BHP has to adopt a “get big or get out” approach to the investments; otherwise, it simply won’t move the dial on its earnings profile, the primary reason it hasn’t ventured into lithium. The war between Russia and Ukraine has seen prices double, creating inflation across the food industry, with potash being a core fertiliser for crops such as corn and wheat.

- First production from Jansen is expected in 2026 before a ramp-up as stage two comes on stream – our “best guess” is prices will be lower then.

We all hope and pray that the conflict between Russia and Ukraine will be over by 2026, but it has already persisted far longer than many imagined, including Mr Putin. Russia and Belarus are two of the world’s largest sources of mineral fertilisers; hence, the war has had a major impact on global food supply. Shortages have been compounded by export restrictions imposed by China, which accounts for 30% of global phosphate fertiliser supplies. As a consequence of measures to protect its domestic market, China’s exports shrunk by 50% in 2022, according to the World Bank – when it rains, it pours!

MM is a huge fan of BHP’s move into the “megatrend” of increased efficiency around food production. In our opinion, this is an excellent bolt-on to the Big Australian’s more typical mining operations in iron ore and copper, plus it’s another example of BHP resetting itself into a cleaner world, i.e. selling oil assets and ramping up into fertilisers. As CEO Ken Henry said, “Potash, used in fertilisers, will be essential for food security and more sustainable farming”.

Moving onto three stocks that focus on the production of potash, both local and overseas: