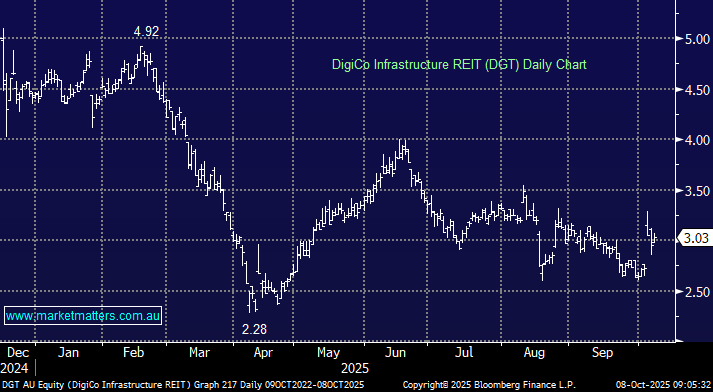

The tailwinds behind data centres are undeniable – it’s a theme we’ve written about extensively at Market Matters, and one we believe has decades of runway ahead. Against this positive backdrop, DGT listed on the ASX on 13 December 2024 at $5 per security, amid plenty of attention, yet it languishes today around $3, down ~40%.

DGT is essentially a specialised property trust — similar in structure to traditional REITs — but instead of owning office towers or shopping centres, it owns data-centre assets and associated digital infrastructure (power, cooling, fibre, and land). They operate SYD1 in Sydney, which is their flagship Australian site undergoing a large expansion, as well as US campuses in Virginia and Texas, targeting hyperscale clients. DGT also has a pipeline of early-stage development sites with power and land secured, taking total billed IT capacity to roughly 85 MW by July 2026 (≈ 44 MW US / 41 MW Australia).

Their performance has clearly been disappointing, and from our perspective, can be attributed to a few key factors:

- A hyped-up IPO that priced in a big multiple for its stage of development.

- Slower-than-expected rollout of new capacity — execution has been below expectations.

- Limited institutional ownership and questions around management fees paid to HMC Capital (the manager), which spun out the assets into this separate listed vehicle.

However, their latest update was more encouraging and suggests things could be turning around from an execution standpoint.

They confirmed last week that 41 MW of capacity is now contracted in Australia versus their prior FY26 target of 27 MW, implying clear improvement. The scale of contracted wins — spanning hyperscale, neocloud, enterprise, and government clients — was impressive and provides solid visibility through FY27 and beyond.

While the earnings impact isn’t material in the near term, management guided to an annualised EBITDA of at least $180 m by FY27, which effectively de-risks consensus expectations (~$179 m).

Data-centre expansion is capital-intensive, and they’ve increased FY26 capex guidance from $100–120 m to $160–180 m, reflecting accelerated deployment. However, this updated guidance materially improves the outlook for SYD1, which had previously been forecast to see declining earnings. There’s also been a clear shift in their customer-contracting approach — recent deals are priced at lower returns (lower $/MW and EBITDA/MW) but over longer-duration contracts. This means higher capacity won’t immediately translate to a step-up in earnings, but longer-term contracts provide greater certainty, reducing execution and revenue risk over time.

According to UBS, DGT now trades on an EV/contracted EBITDA of ~17×, a meaningful discount to global peers such as Equinix (~22×) and Digital Realty (~20×). The runway remains long, and they’re clearly positioned in the right space, but execution has been underwhelming, which kept larger investors on the sidelines. From a balance-sheet perspective, gearing is moderate, providing headroom for continued development and expansion.

- With a solid base of expanding assets and a meaningful valuation discount to peers, DGT is back on the MM radar for the Emerging Companies Portfolio.