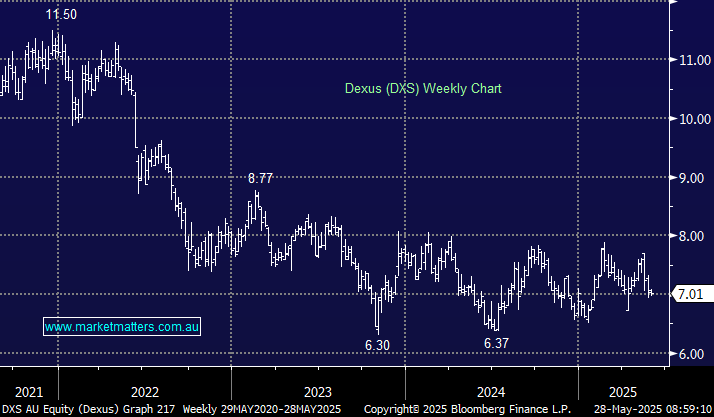

We’ve owned DXS in the past and written about it numerous times, though we don’t own it now. We’re drawn to it for income and the potential for an ongoing recovery in the domestic office market. They are consistent performers, operating in the high-grade office space, with some additional exposure in Industrial. They yield 5.3%, with the next dividend due on the 27th June. We view them as a lower risk property exposure, providing consistency, predictability, but with the solid prospect of better earnings and dividends ahead with the continual improvement in office.

- Earlier in the month, they reiterated FY25 guidance for Adjusted Funds from Operations (AFFO) of 44.5-45.5cps broadly in line with consensus at 45.2cps. They guided to a FY25 dividend per share of 37cps, again, in line with consensus. Their operational metrics remain resilient, with office occupancy at 93.2%, Industrial occupancy at 95.7%, and 100% rent collections. They are now experiencing lower-than-average incentives in Office (25.5%) and Industrial (17.9%) sectors.

One concern across the property space has been that book values were above real values. However, we’re now starting to see a greater volume of transactions, which implies values are holding up better than feared. At their last reported Net Tangible Asset (NTA) update in December, DXS reported an NTA of $8.81, down from $8.97 at 30 June 24, implying DXS is trading at a 20% discount to the carrying value of its assets.

The office dynamics are pretty clear, with a flight to quality and CBD concentration the primary trend. Dexus has 76% CBD exposure in high-grade properties, and DXS management noted that leasing momentum continues, one interesting metric being that sublease availability across major CBDs is down over 50% from 2020.

- On a 5.3% yield and improving underlying dynamics in high-grade office, DXS remains well-positioned for mild growth in earnings and dividends, and trades on an attractive PE of 11x.