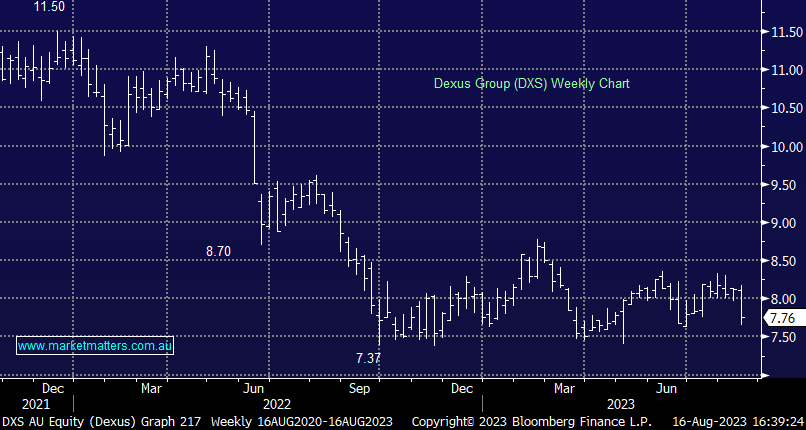

DXS -3.12%: Shares fell today as they reported FY23 results, and offered guidance for the year ahead. The key to any result is around determining what is known information versus what is new information. For FY23, DXS booked Funds from Operations (FFO) of $738.5m ahead of consensus $728m & a dividend 51.6cps, inline with consensus expectations. FY24 guidance is for FFO to be broadly inline with FY23, which is slightly better than the current consensus (50.5cps) implies, while they have guided to a DPS of 48cps versus 50.5c consensus. Assets were revalued (lower) by ~6.9% which led to a net loss of $752.7m. Putting that number into perspective, it took 11.4% off the NTA, which declined to $10.88 per share, which as of today’s close, places the stock at a ~29% discount to NTA.

- Coming into this result we were well aware of likely asset revaluations lower, soft earnings and a tough outlook, our premise for owning DXS is that the discount to NTA is too great, for the quality of their underlying asset base, solid balance sheet (gearing 27.9% /84% hedged), while we can pick up a 6% (unfranked) yield while we wait for global office fundamentals to turn.