The Active Income Portfolio has performed very well in this recent correction, highlighting the benefit of a more diverse asset allocation structure and the value of holding companies with defensive earnings in times of market stress. During the March quarter, the portfolio experienced a maximum drawdown of only 4% relative to a near 20% pullback in equities. Further, the defensive positioning has not come at the expense of capital gains with the portfolio capturing more upside than the ASX200 (Incl dividends) since the 2020 Covid low with reduced downside capture being the primary reason (maximum 5-year drawdown of 11% and a standard deviation of 10% through periods where equities have corrected 10-20% on three separate occasions).

There has been a lot of uncertainty in recent years, with the overhang from Covid creating inflationary pressures leading to sharply higher interest rates, a barrage of geopolitical tensions and now a Trump Trade War. In times of uncertainty, it makes sense for investors to tilt portfolios away from cyclicality into more defensive investments. This has undoubtedly been very obvious over the past quarter, but it’s really been a persistent theme for several years now.

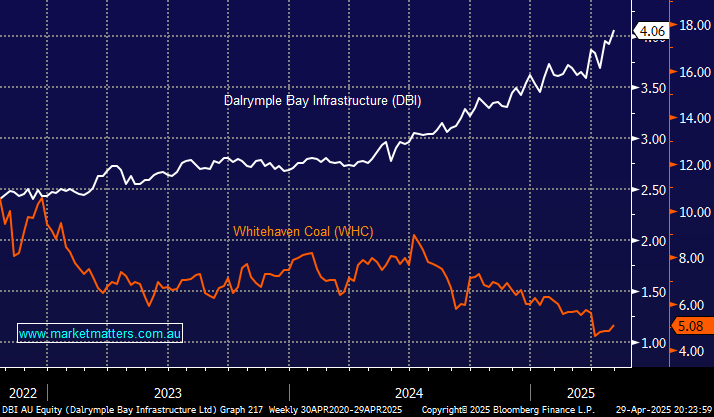

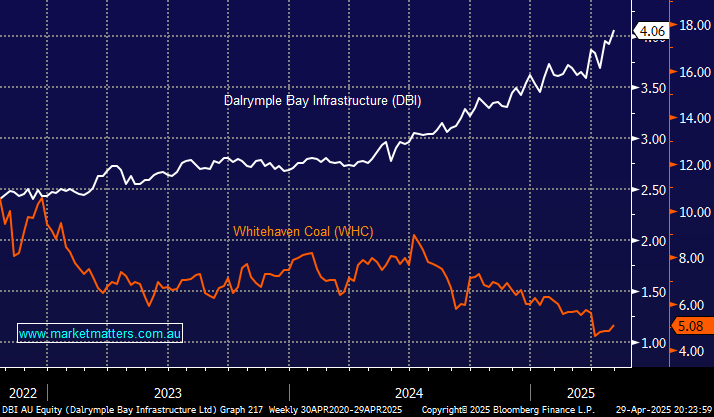

An example of defensives winning at the expense of cyclicals is the relative performance of coal miner Whitehaven (WHC) vs. coal terminal operator Dalrymple Bay Infrastructure (DBI). i.e. sell the cyclical coal miner exposed to the ups and downs of commodity prices and buy the defensive coal port operator exposed to volumes (with take-or-pay contracts in place).

While we’ve much preferred looking at our Income Portfolio during recent market turmoil, our contrarian nature has us pondering what comes next for the defensive vs cyclical trade, or in terms of Market Matters strategy, is the recent outperformance of the defensive income portfolio compared to the recent underperformance of the cyclical growth portfolio telling us an important message that we should heed?

In the past week, we have talked to institutional dealers who tell us there is still a more defensive tilt to institutional flow as most investors continue to express expectations for lower economic growth predicated on tariffs. While this move toward defensives has certainly helped support the performance of the MM income strategy, we now question if this move toward defensives relative to cyclical is nearing exhaustion. How will bid-up, over-owned defensives perform on any incrementally positive news coming from tariff negotiations?

We know the market is very concerned about a further deterioration in global growth, with significant cuts priced for interest rates being the main telltale here. Lower interest rates do make defensive income stocks more attractive, but we ultimately think positioning could become more influential. With investor positioning in defensive stocks now at high levels relative to cyclicals, if growth doesn’t deteriorate as much as the market now expects, we can envisage a scenario where defensives give up some of their recent outperformance and cyclicals bounce back, potentially very hard. Gold could also be telling us this with what looks like a blow-off style top in place for the crowded long trade.

- While the income portfolio will stay defensive overall, we are now looking to mildly tilt it towards higher-yielding cyclical stocks. Importantly, we’re certainly not chasing bid-up defensives at this stage of the cycle.

An example of this would be Telstra (TLS), a position we’ve held in the portfolio for several years. We are more likely sellers than buyers at $4.50, trading on 21x and yielding 4.3% fully franked.