The owner of the iconic John Deere brand reported stronger-than-expected 2Q earnings overnight. However, they lowered their FY guidance due to weakening ‘farm economics’ in most areas, with particular softness coming through in North America. Deteriorating global agricultural markets at a time of elevated inventories are likely to put downward pressure on 2H production, and they lowered their FY24 profit guidance by 8%. The stock fell nearly 5% on the session.

For Q2, conditions were strong with profit of $US2.37bn ahead of the $US2.16bn expected based on stronger sales and very good margins. As sales decline in the 2H, margins will be lower. However, it seems from the guidance that they will defend prices, i.e. not discount, and be more aggressive in pulling back production to avoid too much build-up of inventory.

The outlook is not DE-specific. Earlier this month, tractor makers CNH and AGCO also reduced their outlooks for 2024, calling out declining sales of farm machinery. Stocks of other machinery companies have also pulled back—Caterpillar and Cummins are two other examples.

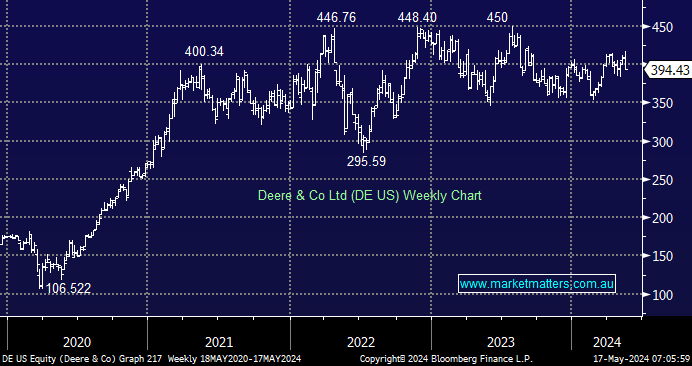

- While we like the DE US business, the global outlook for Ag is getting tougher in the 2H, so we’re considering taking profit in the short term.