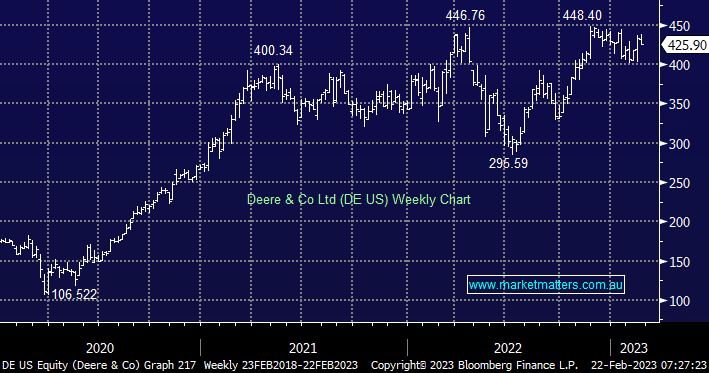

When farmers are making money, they buy machinery and as supply chain pressures ease, Deere & Co is now in a very good position to take advantage of this growing demand through better pricing which sees stronger margins – a theme that has started to play out as reported in their Q1 update last week where they beat expectations and raised full-year earnings guidance – the stock ‘popped’ ~7% on the day. For the quarter alone they did $US11.4bn in equipment sales and are now guiding to a full-year net profit of between $US8-8.5bn which puts them on a PE of 14x, with profit growth of 23% for this year – clearly attractive.

Their order books are full, so dealers are unlikely to be able to restock their inventories this year which means that buying to restock will support sales next year as well, while they also spoke to wider trends around aging farm equipment and the increased productivity that is generated from their products, one of the main reasons we originally bought the shares. Overall, a very good start to the year for Deere, a company that we think will continue to perform well into 2024.