DYL is a high-beta player among the leading ASX uranium stocks as it enters advanced-stage uranium exploration at its core Namibian project known as Tumas. The final investment decision (FID) on Tumas is expected before Christmas, as improving sentiment towards the sector will only help. Assuming the project gets the go ahead, they should be producing U308 by the end of CY26, following a capex spend of ~$US360. They have around $250m in cash, however, other funding will be required.

We prefer owning producers relative to explorers at this current juncture, though DYL is an option for our higher risk, Emerging Companies Portfolio.

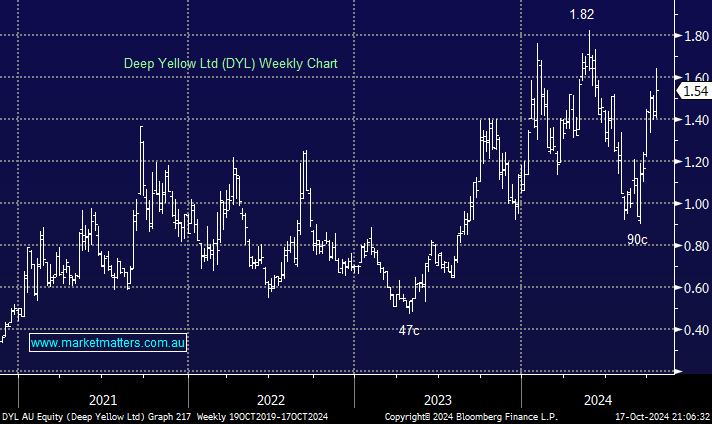

- DYL look on point to test $1.80 into Christmas, and it may outperform short-term if the sector continues to surge.