We’ve mentioned DBI before however they reported last week and the result was a little confusing, particularly around the distribution given they talked about an aggregate $22.5m being paid out, however the key takeaway is that it’s on track to meet prospectus forecasts and yield more than 8% based on current prices.

Last week’s result was their FY 20 numbers and there were some important aspects to it. Given COVID + Chinese restrictions on Coal, only 55 million tonnes went through the coal terminal versus 80mt which is contracted, however, revenue stayed stable given customers are on take or pay contracts (i.e. they pay anyway). They’ve also made the decision to pay quarterly distributions rather than half yearly, and confirmed the first distribution would be ~4.5c which annualised equates to ~18c, or a yield of 8.7% based on $2.06.

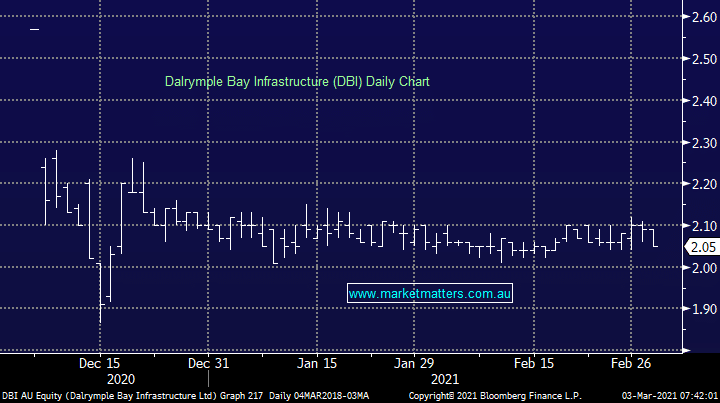

They also announced a share buy-back of up to 10% of the stock, although we find it hard to see how they will pay for this and still push forward with their expansion program – probably more an aspirational target and a sign they are conscious that shares are trading at a ~20% discount to the IPO price of $2.57.