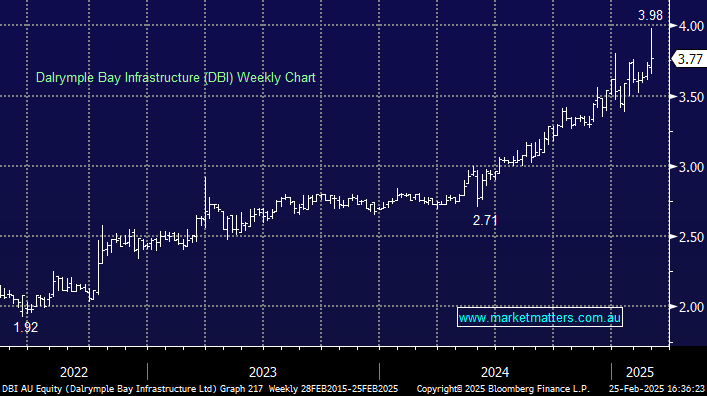

DBI +0.8%: Rallied to new all-time highs today on solid FY24 results and guidance for the year ahead, though the best of it was seen early, with a fairly meaningful pullback later in the day.

- FY24 revenue of $767 million, up from $654.8 million and handily ahead of $692 million expected.

- Earnings per share (EPS) $0.16 from $0.15 last year.

- It’s all about the dividend for this, with a quarterly dividend of $0.05625 up from $0.05375.

They have guided for the next two distributions to be $0.05875 per security, aiming for annual distribution growth of 3% to 7%. This is a steady infrastructure stock delivering where many other infrastructure stocks are failing at the moment.