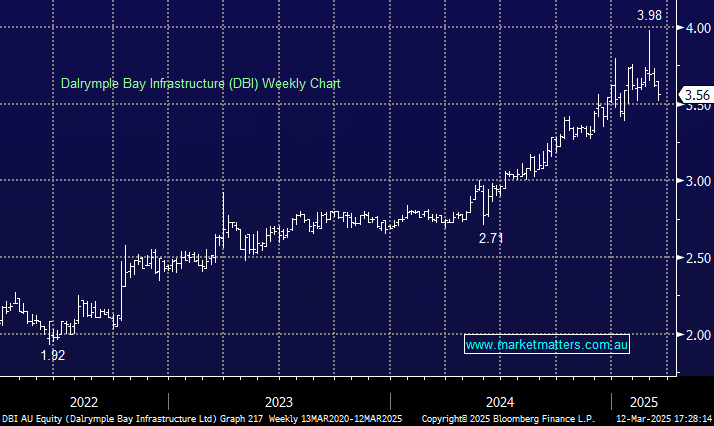

Last month, the owner and operator of the Dalrymple Bay Coal Terminal QLD delivered a strong FY24 result and guidance for the year ahead, exactly what you want to see if you hold a stock for reliable and sustainable yield:

- FY24 revenue of $767 million was up from $654.8 million and 10.8% ahead of the $692 million expected.

- The quarterly dividend of $0.05625 was up from $0.05375, putting the stock on a part-franked 6.4% yield.

They have guided the next two distributions to be $0.05875, aiming for annual distribution growth of 3% to 7%. This is a steady infrastructure stock that is delivering, whereas many other infrastructure stocks have struggled recently. Revenue is underpinned by take or pay contracts ensuring long-term contracted earnings.

- We believe DBI remains great value ~$3.50 and we own the stock in our Active Income Portfolio.