DBI owns and operates a 99-year lease on the coal export terminal called the Dalrymple Day Terminal (DBT) at the Port of Hay Point on the Central Queensland Coast (about 40kms from Mackay) .The terminal exports primarily met coal used in steel making, which has a long future, servicing the Bowen Basin coal mines run by the likes of Rio, Glencore, Anglo & BHP Mitsui. They push coal through DBT on what’s called take or pay contracts, meaning their contracted for volumes which the terminal gets paid for irrespective of whether or not they move coal through the terminal coal, which makes DBI a stable infrastructure asset, throwing off consistent earnings that will grow over time.

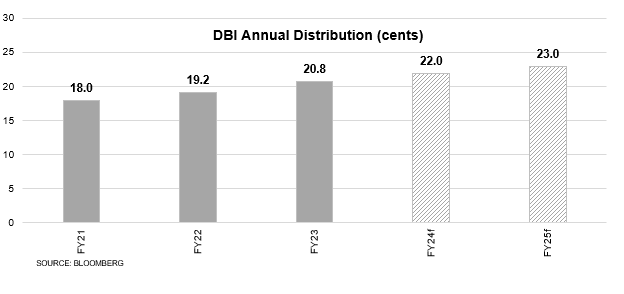

At their recent 1H24 results, DBI said they are targeting growth in future distributions per security of 3-7% for the ‘foreseeable future’. They currently trade on a yield for FY25 of 7.14%, 60% franked, which grossed up is ~9%, growing above inflation, which makes this a very interesting, defensive yield play, particularly in an environment where the risk-free rate (i.e. interest rates) are likely to decline. All things being equal, that increases the appeal of stable income such as the one produced by DBI.

We previously held DBI in our income portfolio (a few years ago), but sold out too early. We like it, although its structure is a little complicated. DBI is structured as a stapled security, meaning that the security is a single share in DBI stapled to a non-interest-bearing loan note issued by DBI. The security pays a dividend, which is franked, while the loan component is a repayment of principal on the non-interest-bearing loan notes issued by DBI, which has the impact of reducing the cost base of that part of the security over time. A simpler way to think about this is to view the holding separately as a share and a loan note.

- Approx.9% yield that’s growing at least 3% pa, stable earnings, critical infrastructure in an environment of falling interest rates – we think DBI stacks up for income.