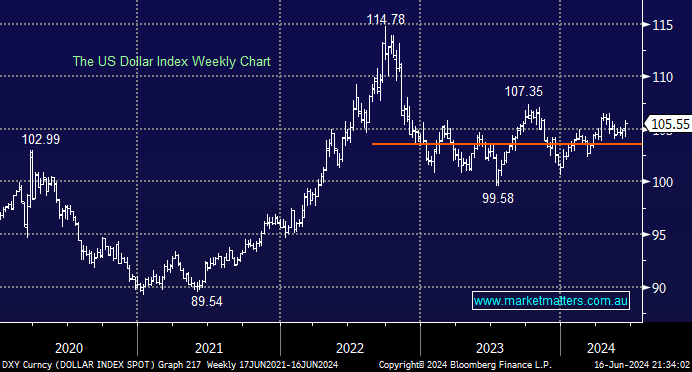

The Greenback bounced last week as the Fed pushed their timing of interest rate cuts further down the road, although ironically, the softer inflation data did support a more dovish approach to rates. However, with the Eurozone becoming increasingly fixated on the French elections, the $US did enjoy a small “safety bid”, which was enough to see the currency rally back above the 105 level as it continues to rotate in the same range as the last 18 months.

- We are net bearish on the US dollar through 2024/5, initially targeting a retest of the psychological 100 area.

While Europe dominates the news, the Japanese Yen continues to struggle against most major currencies. Last week, it stayed within striking distance of multi-decade highs against the US Dollar after the BOJ left short-term interest rates unchanged at between 0% and 0.1% at its 2-day meeting, as was largely expected, i.e. there is no yield for investors holding cash in Japan.

- We are targeting a break to new highs above 160 in the coming weeks by the USDJPY.