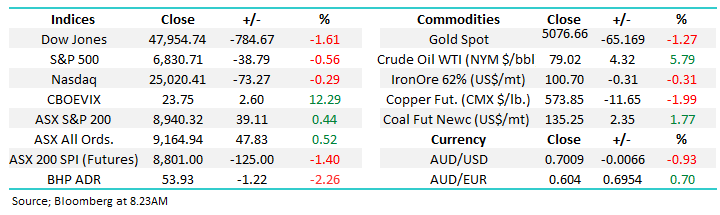

The Greenback experienced a quiet week even after the hawkish Fed Minutes. The $US has been comfortable trading around 105 for the last 18 months, and it’s clearly going to need more than a few comments from Jerome Powell et al. to change this equilibrium. Until the market becomes convinced that the battle against inflation has been won and interest rates can move sustainably lower, the $US is likely to remain in its current trading range.

- We remain net bearish on the US dollar through 2024/5, initially targeting a retest of the psychological 100 area.

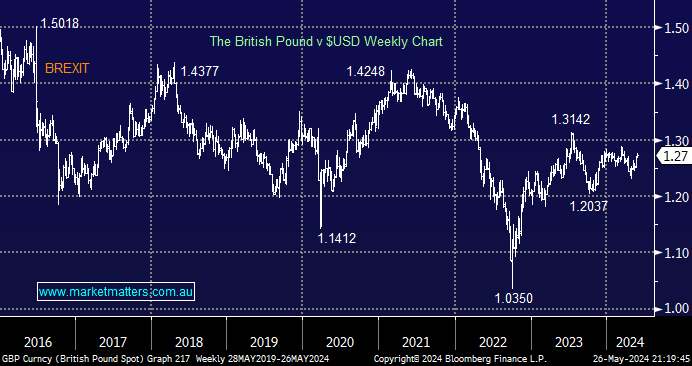

The UK is heading to the Polls, and a change of government looks likely as the Conservative government pulls out all the stops to retain power after running the country for 14 years. One eye-catching new policy is to bring back compulsory national service, which we assume is aimed at winning the “older” vote. Whoever wins the Pound remains firm, and we believe the next 10% move is on the upside.

- We are targeting a test of the 1.40 area for the Pound through 2024/5.