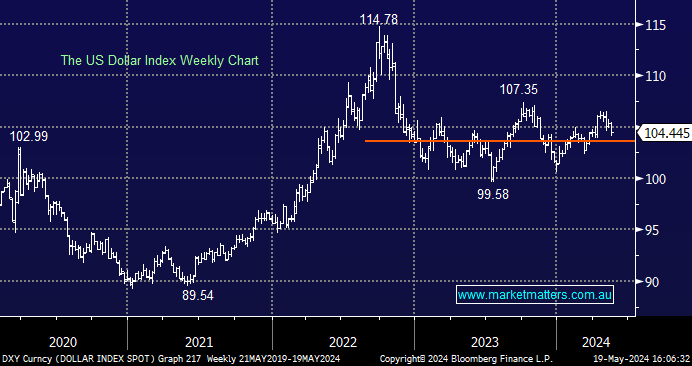

The Greenback fell away last week after the CPI inflation numbers led to credit markets pricing in two or three rate cuts in the next nine months. This renewed dovish stance, after April’s hiccup, is bearish towards the $US as cash parked in the US will start to deliver a lower yield, lessening the demand for dollars.

- We remain net bearish on the US dollar through 2024/5, initially targeting a retest of the psychological 100 area.

Since COVID, the Yen has been under pressure courtesy of simple interest rate differentials, i.e. Money held in Japan (Yen) pays no yield compared to Australia. The BOJ was rumoured to have intervened to stem the Yen’s volatile decline last month, but it’s had no impact against the Aussie, which has appreciated ~20% against Japan’s currency over the last year.

- We wouldn’t fight the AUDJPY’s uptrend as China starts to fuel a kick-up in commodity prices.