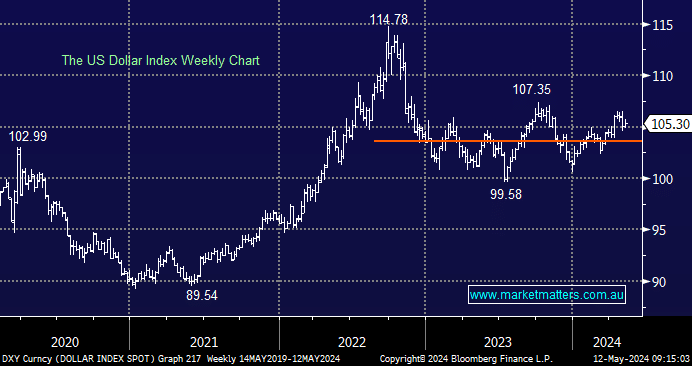

The Greenback remained around 105 last week. We expect much of the same ahead of Wednesday’s CPI inflation print. A number much below 3.4% will be perceived to open the door for Fed cuts, which will push down the US dollar. The US dollar has remained in the same 100-107 trading range for the last 18 months, and although we’re net bearish, it will need to see a meaningful decline in inflation before we’re likely to retest last year’s 100 swing low.

- We remain net bearish on the US dollar through 2024/5, but it looks comfortable around 105 for now.

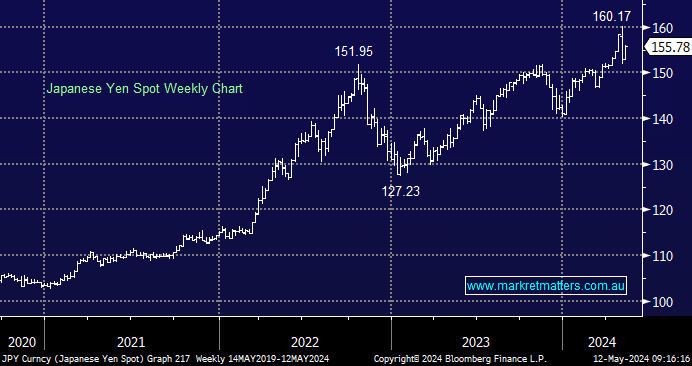

The Yen has been under pressure since COVID on basic interest rate differentials: the Fed’s target cash rate is 5.5% at the Upper Band, whereas the BOJ recently hiked rates for the first time in 17 years, it’s hard to comprehend, but they’re still in the 0.0-0.1% range. Money being held in Japan (Yen) is paying no yield compared to Australia and the US. In recent weeks the BOJ has been rumoured to be active in the currency market in an attempt to stem the Yens decline, or at least to make it more orderly as it falls to multi-year lows.

- We wouldn’t fight the USDJPY’s uptrend, but volatility is likely to increase as markets brace for ongoing BOJ intervention.