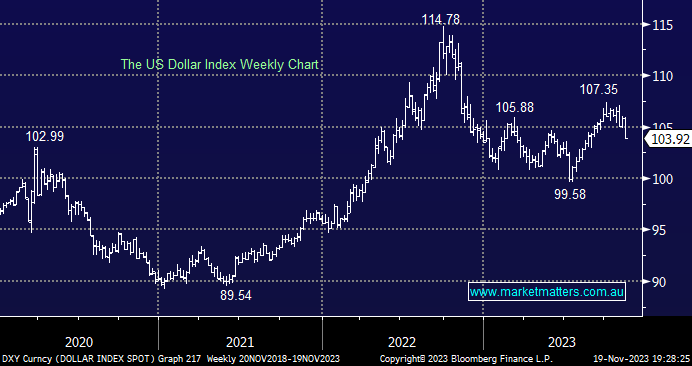

The $US followed bond yields lower last week, as would be expected. If we are correct, the Greenback has now formed a major swing high, and it will eventually test/break the important psychological 100 area. At this stage, the $US has traded in a fairly tight albeit choppy range through 2023; this morning, it is set to open in the middle of its last 12-month range, with follow-through in either direction likely to be determined by bond yields – like most markets!

- We remain net bearish towards the $US, but downside follow-through by bond yields will be required before the Greenback can turn meaningfully lower.

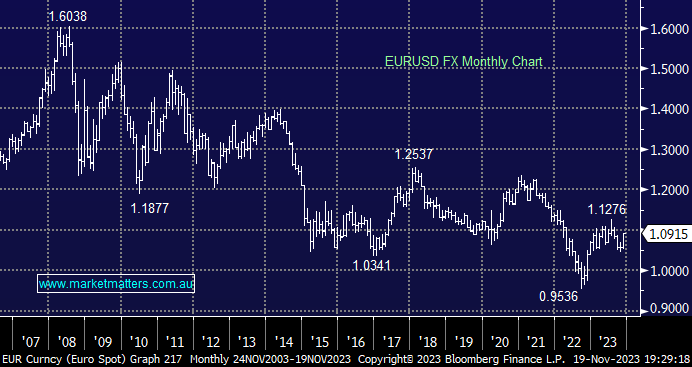

The Euro has been consolidating for months, but it’s now threatening to break out on the upside, in line with our medium-term view. Assuming we are correct, this is an excellent read-through for risk assets and gold but not ASX $US earners.

- We remain bullish towards the Euro with an initial target around the 1.25 area or 12% higher.