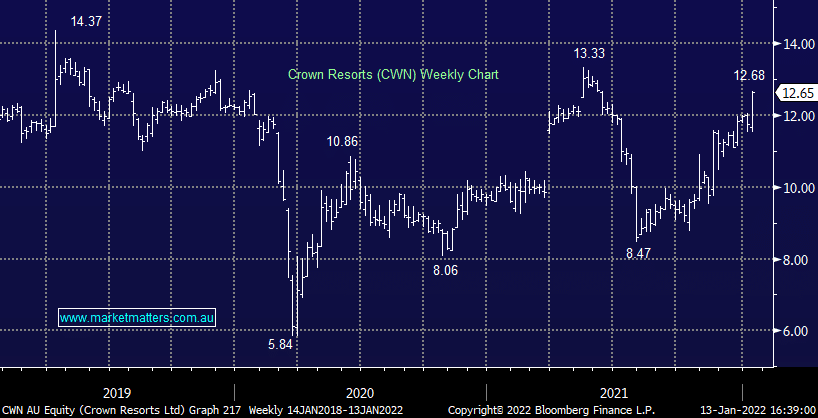

CWN +8.77%: the casino operator received an improved bid from US Private Equity group Blackstone today, a ~5% improvement on the initial offer back in November. The new bid comes after months of discussions and a peak behind the curtains of Crown but still remains conditional on further due diligence and the usual caveats of regulatory approvals. The Crown board was more welcoming of the new price saying a unanimous board vote would need a bid of at least $13.10/sh, bang on Blackstone’s offer. Ultimately Crown is a keen seller, providing a get out of jail free result for James Packer and the board which has been under immense scrutiny from regulators on a number of fronts. Blackstone is a canny operator seeing value in their assets. This is obviously a positive for equity holders but also debt holders in the Hybrids.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.