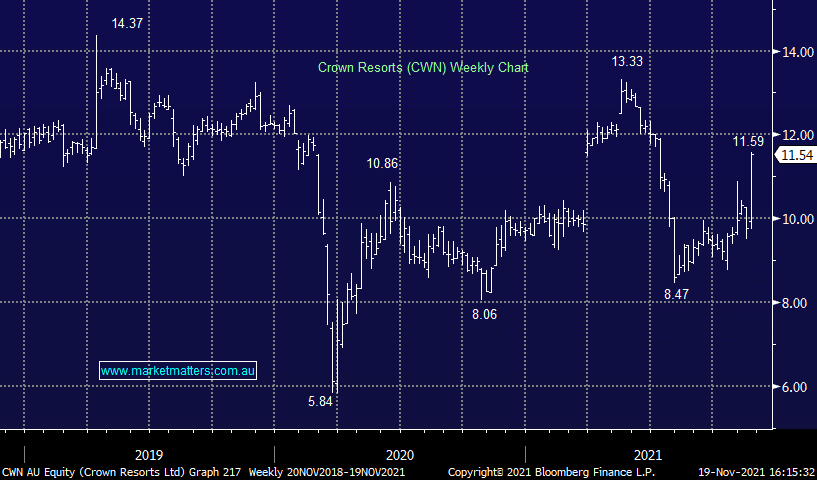

CWN +16.57%: received another takeover bid today from its 2nd largest shareholder behind JP, namely Blackstone. This is now the 3rd time Blackstone have approached CWN and have now upped their offer to $12.50 cash, valuing the company at about $8.5 billion. They had bid $11.85 in March and $12.35 in May. The price in +25% premium to last close but remains conditional on a few things, including Blackstone doing due diligence on an exclusive basis and the global investment firm receiving final approval from its investment committee + they also want complete board support. We think a deal will get done here, however the market is rightly sceptical given recent history of failed buyouts. This is obviously positive for the shares + also positive for the Hybrids (CWNHB) we hold in our income portfolio.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.