Strong demand from yield-hungry investors is driving a surge in developing-world bond sales as borrowers race to secure financing ahead of any further uncertainty across global markets. Since the beginning of the year, emerging-market governments and companies have sold $331 billion in debt denominated in hard currencies like the dollar and euro, according to data compiled by Bloomberg. That is the fastest pace in four years and already surpasses the total in the first half of 2024. Investors have fueled a broad rally in international assets amid questions about the long-standing dominance of US markets, which have sent the value of the dollar down.

- We can see stocks following suit in the 2H of 2025, becoming more edgy as they look for value in a rich market.

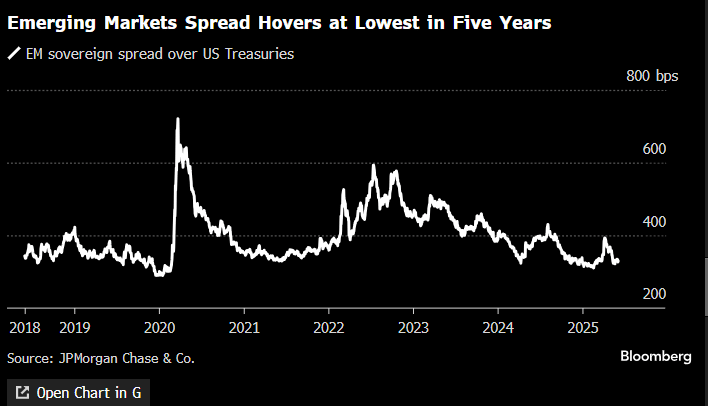

The higher yield investors demand to hold dollar bonds from emerging countries over US Treasuries has fallen and is now hovering close to its lowest level since 2020, according to a JPMorgan index.