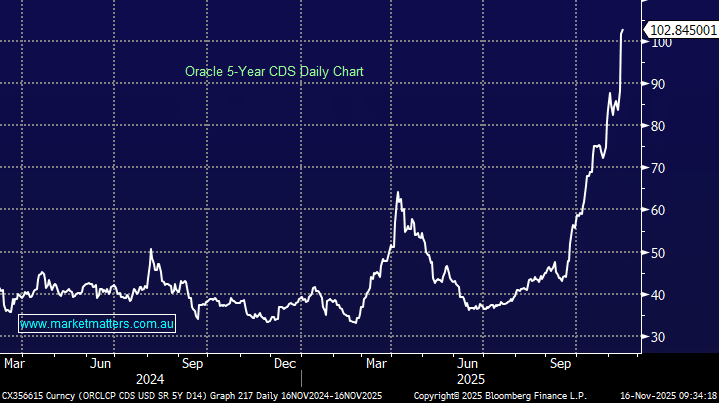

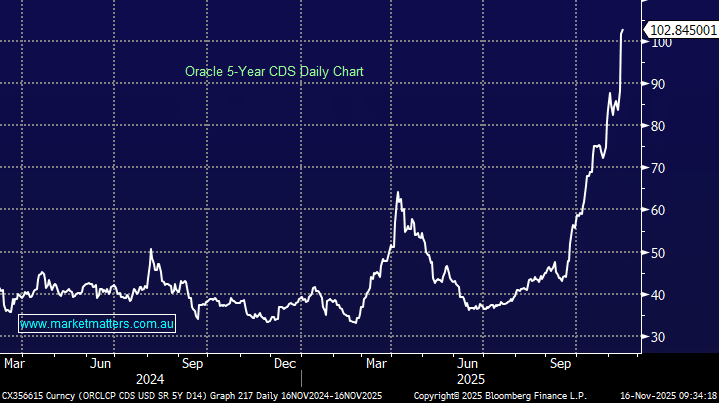

As tech companies gear up to borrow hundreds of billions of dollars to fuel investments in AI, lenders and investors are increasingly looking to protect themselves against it all going wrong. Banks and money managers are trading more derivatives that offer payouts if individual tech companies, known as hyperscalers, default on their debt. Demand for credit protection has more than doubled the cost of credit derivatives on Oracle Corp.’s bonds since September.

Investment-grade companies are estimated to sell around $1.5 trillion of bonds in the coming years, with a series of big bond sales tied to AI have hit the market in recent weeks, including Meta Platforms selling $30 billion of notes in late October, the biggest corporate issue of the year in the US, and Oracle offering $18 billion in September. Some of the biggest buyers of single-name credit default swaps on tech companies now are banks, which have seen their exposure to tech companies surge in recent months, they’re more vested than equity holders!

Buying protection on Friday against Oracle defaulting within the next five years cost about 1.03%, or around $103,000 a year for every $10 million of bond principal protected. Bonds are flashing concern that optimism around the massive investment in AI isn’t going to deliver $$ at the end of the day.

- Investors are adopting an across-the-board “risk off” attitude towards bonds and equities alike.