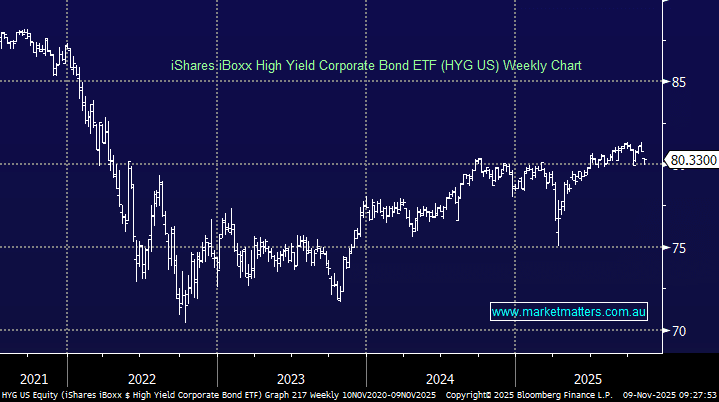

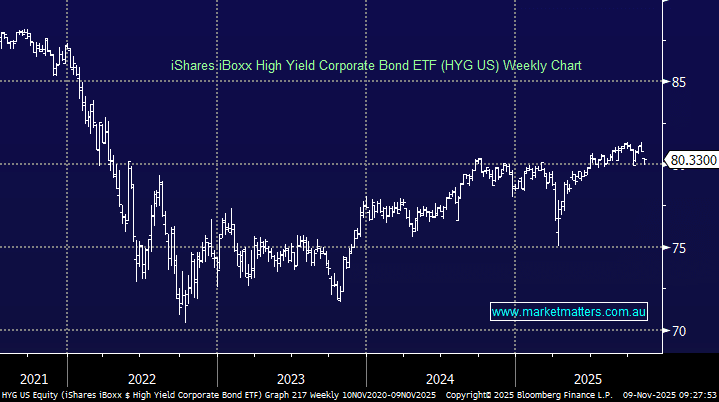

Junk bond investors are showing greater caution. In the past month, the US index of CCC-rated bonds has fallen nearly 0.8%, underperforming the broader high-yield market as investors shy away from the riskiest debt. Distressed US dollar loans climbed to about $71.8 billion at the end of October, the highest level since Trump’s tariff announcements in April. The shift signals that the rally in lower-quality credit is losing momentum, especially for the weakest issuers.

- Investors are adopting an across the board “risk off” attitude towards bonds and equities alike.