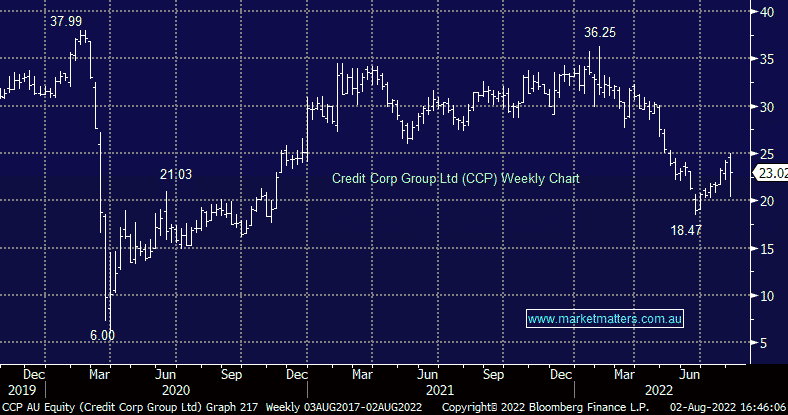

CCP -5.35%: The debt collector reported net income today of $100.7m for FY22, ahead of the $96.6m expected, and a final dividend of 36cps which was inline. The profit result equated to a 14% increase on FY21 so clearly a solid outcome, however, their guidance for FY23 caused some concern, they are guiding to net income of $90-$97m and Purchased Debt Ledger (PDL) acquisitions of $220-$260m. PDL’s are essentially their inventory, they buy the debts and then work to recover them, less availability of bad debts = less inventory = lower earnings. The stock was down ~15% in early trade but recovered throughout the session. On 14x FY23 earnings, CCP is about fair value in MM’s view.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral/marginally positive CCP around $23.00

Add To Hit List

Related Q&A

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

MM’s thoughts on CCP, CHC & GMG?

MM’s thoughts on CCP, CCX & CHC v GMG

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.