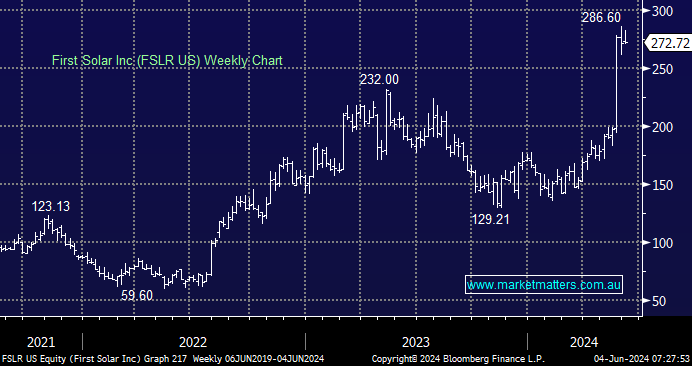

Solar stocks have roared back into favour this year as the world searches for carbon-neutral energy alternatives. Overnight, we saw Goldman Sachs raise its price target for First Solar (FSLR US), a stock we’ve held since mid-2023. The US powerhouse cited tailwinds from tariffs and data centre demand looming on the horizon, providing further room for the stock to run even after its 80% surge over the past two months – “We remain bullish on the outlook for FSLR and believe several tailwinds could support higher [average selling prices] or potential capacity expansion,”.

While global tariffs are a very real story, it’s the demand side of the equation that interests us today. The data centre explosion to cope with AI has already delivered huge positive results for the share prices of Goodman Group (GMG) +35% and NEXTDC (NXT) +30% through 2024. Also, the local energy utility stocks are starting to benefit from the theme, with AGL Ltd (AGL) up +11% and Origin Energy (ORG) +22% year to date.

One thing not regularly discussed about AI is the huge amount of energy it consumes just when we’re supposed to think about electric cars and solar panels to reduce our carbon footprint. AI is in its infancy, yet it is already using as much energy as a small country. The International Energy Agency (IEA) forecast that by 2026 AI could use as much energy as all of Japan, not very green!

- We hold FSLR in our International Companies Portfolio.

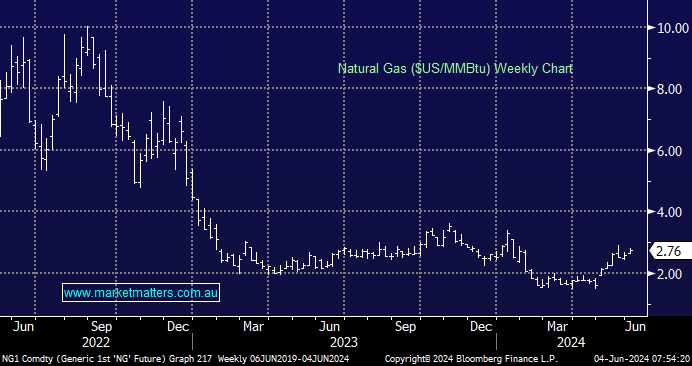

We started writing this report yesterday evening after contemplating that if solar stocks are running strongly on the back of the increased energy demand from AI, surely that narrative could support coal in the shorter term. On cue, European natural gas prices surged higher as flows out of Norway slumped, highlighting the risks faced by consumers relying on one source of energy supply. The overnight ~10% pop in natural gas prices illustrates how fragile our supply & demand position is for global energy needs; ironically, on the same night that OPEC news knocked crude oil ~3.5%.

- We believe fossil fuels will be needed to meet exponentially increased demand from AI, especially if/when China’s economy regains its mojo.

One of MM’s core views is that the world is too optimistic about its need for coal to effect a smooth transition to clean energy. The latter will take longer than many hope, especially as AI is driving up demand. This morning, we looked at three coal stocks, two local and one in the US.