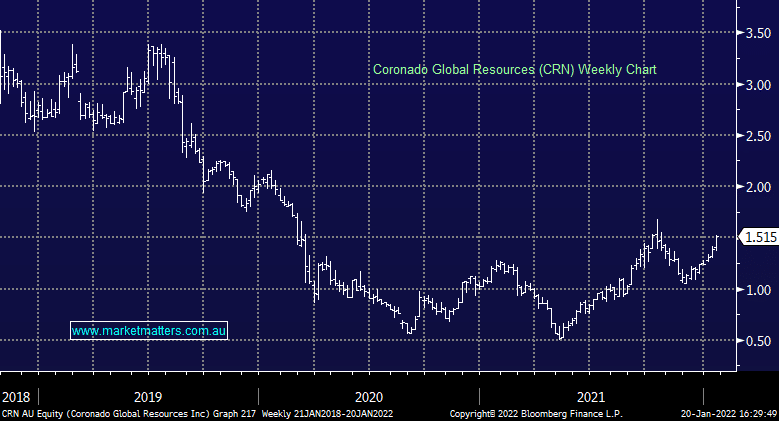

CRN +5.94%: a strong day for the coal company with the 4th quarter production coming an ahead of expectations. Saleable coal production for the full year of 17.4mt was slightly ahead of 2020, and a small beat to guidance that was revised lower in December. Revenues were strong and Coronado managed to finish the year with a net cash balance of $US123m, extremely well-funded for growth and capital returns for shareholders – we should hear more on this front at the full year result next month, the same will likely happen with Whitehaven Coal (WHC).

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains bullish and long CRN

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on Coronado Global Resources (CRN) please

Queries on Coronado Global Resources (CRN) and Treasury Wine (TWE)

CRN SHARE PRICE SITUATION

CRN guidance downgrade

Reporting update on 3 stocks- CRN, CAJ and MVF

CRN – Update?

Thoughts on Coronado (CRN) and Strike Energy (STX)

Comments on BHP, WDS and coal stocks?

Is coal a buy into this weakness?

This weeks Commodities Webinar

Thoughts on Aurizon & Coronado Coal (CRN)

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.