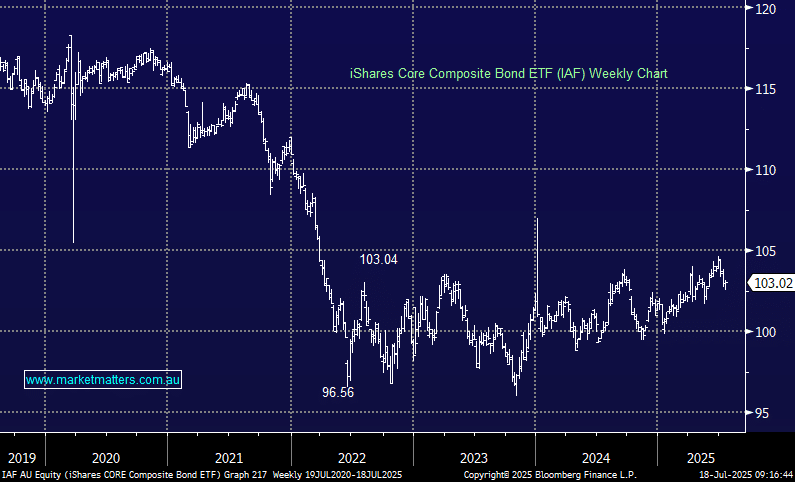

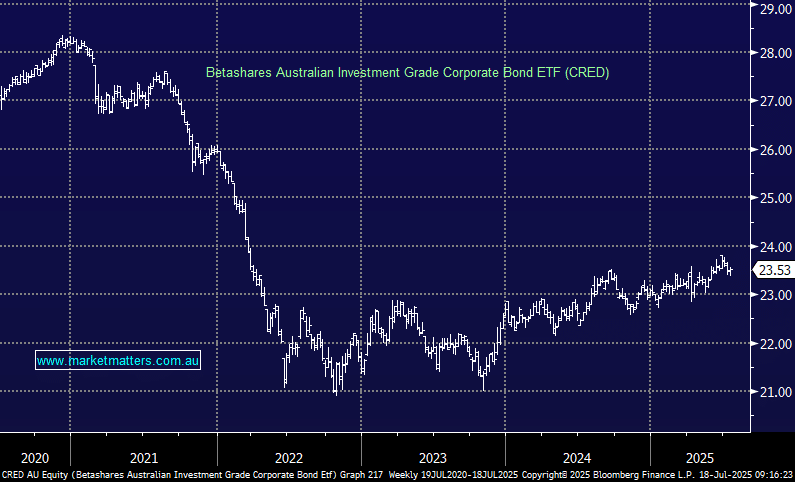

The iShares Core Composite Bond ETF, which we hold with a 17% portfolio weighting offers exposure to a diversified portfolio of investment‑grade fixed income securities that includes lower risk government, semi-government and sovereign bonds, along with corporate bonds. We are reducing this security to make an allocation to the Betashares Investment Grade Bond ETF (CRED), which has the effect of increasing the proportion of fixed income exposure holding corporate rather than government debt. A slightly higher risk for a slightly higher return.

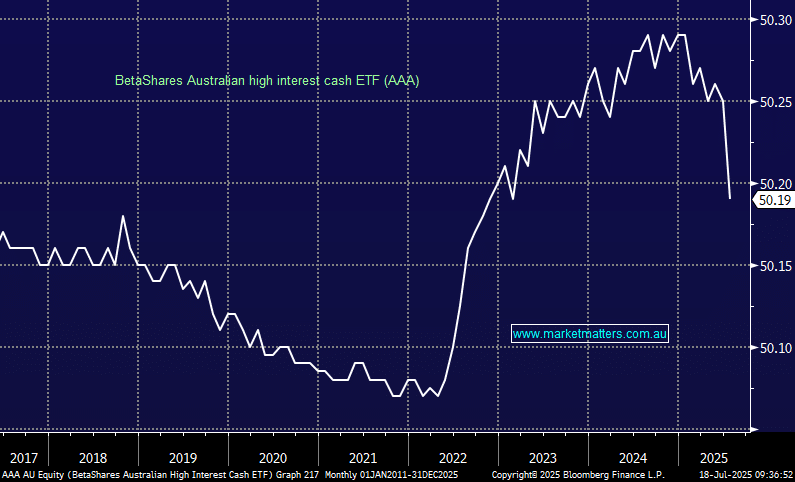

We are buying into the Betashares CRED ETF which holds a diversified portfolio of fixed rate, investment grade corporate bonds, offering a higher return relative to the IAF. We are allocating 10%, with 7% coming from IAF and 3% from the Cash ETF (AAA)

We are using 3% cash held in the AAA ETF to increase exposure to fixed rate corporate bonds.