This morning, we’ve revisited the copper space, which is poised to benefit from the EV boom and a pick up by the Chinese economy, although the timing of the latter is open for conjecture.

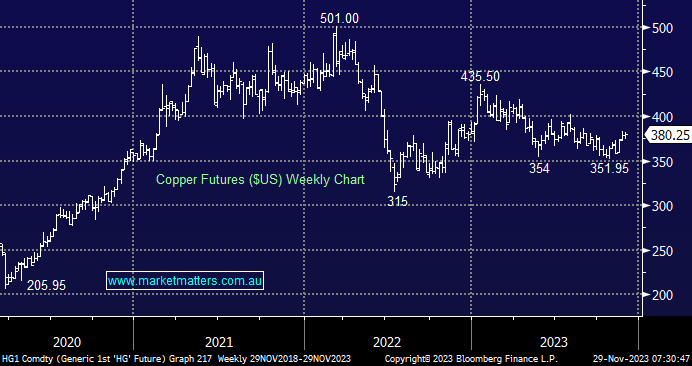

Copper has languished through 2023, falling ~20% from its January high as Beijing struggled to kick-start its post-COVID economy – we believe their targeted response will ultimately prove successful, but they aren’t bowing to market pressures as they adopt a slow and steady approach. There are a couple of important points to clarify with regard to our view on copper:

- Copper remains our preferred commodity to “play” the EV revolution, although, after its 80% plunge through 2023, lithium feels poised to bounce.

- We hold three stocks in our Active Growth portfolio with significant copper exposure: BHP Group (BHP), Evolution Mining (EVN) and Sandfire Resources (SFR), with the latter the pure play.

How we increase/decrease our copper positioning will depend on a number of factors, with iron ore and gold front and centre with regard to BHP & EVN, respectively. There is also a very important contradiction in our macro outlook for the global economy, i.e. we are bearish bond yields, which implies subdued growth, which is not good for “Dr Copper.” Hence, we do not have our blinkers on with regards to the ‘Copper trade’, we may be active here in the shorter term despite our medium to longer-term bullish view i.e. it may take a while for the industrial metal to retest $US4.50.