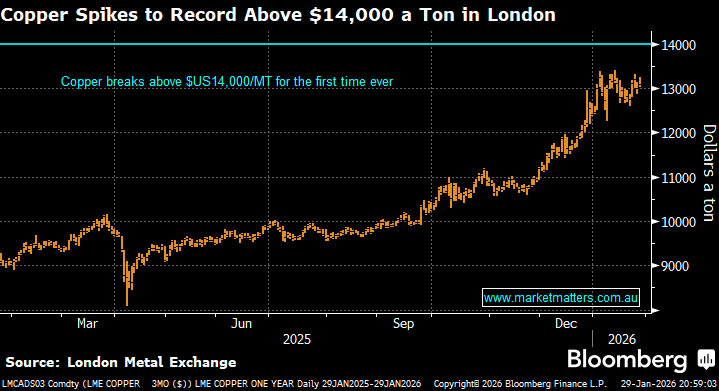

It feels like commodities are taking turns to rally, and yesterday copper really came to the fore, popping above $US14,000 for the first time. Thursday’s intraday move was the biggest since 2009, when China was rolling out massive stimulus measures in the aftermath of the great financial crisis. SHFE futures closed up 5.8% while other metals rallied, with aluminium and zinc also enjoying strong days. Investors have been flocking in particular to metals needed in major growth markets. Tesla Inc.’s plan to spend $US20 billion this year shifting resources to robotics and AI is an example of this big shift. Copper, aluminum and tin would all be beneficiaries.

- We continue to like the tailwinds supporting copper, but in the short term, yesterday’s volatility was extreme, making us reticent to chase here and now.

Turning to the ASX-listed copper (Cu) ETF we like — is this the best way to gain exposure to the global electrification theme?