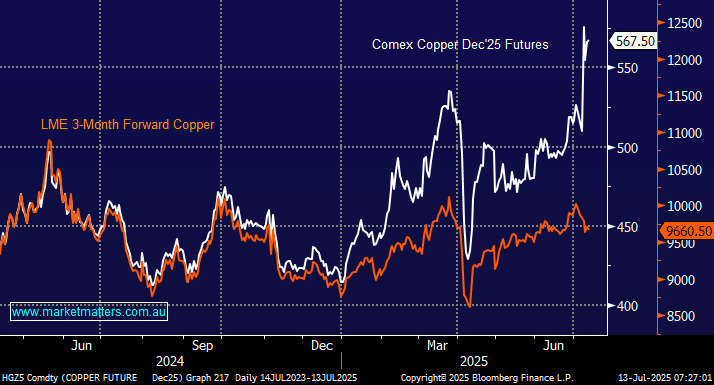

Copper (Cu) has just experienced a once-in-a-generation trade experience courtesy of tariffs, which has left the industrial metal ~25% more expensive in the US than Europe, although the tariff is a whopping 50%! The Arbitrage traders have enjoyed a field day, or at least they should have, with some traders describing deals yielding more than $1,000 on every ton of copper, an unprecedented sum in an industry where a good trade rarely nets $100. The game was simple for those who could play, buy Asian Cu and deliver it to the US, with many seasoned traders describing it as the best physical trading opportunity they had ever seen.

The arbitrage trade has sucked hundreds of thousands of tons into US ports, some of which is now piling up outdoors on wharves along the Gulf Coast as traders hunt for space in bulging warehouses. New Orleans, the industry’s main storage hub for copper in the US, has become the focal point of the entire global market, leaving China and the rest of the world dangerously short of inventory. The president has now set the endgame in process after announcing he will impose 50% tariffs on copper imports starting August 1st. The news initially sent US prices to fresh all-time highs, but calm has slowly returned to the market.

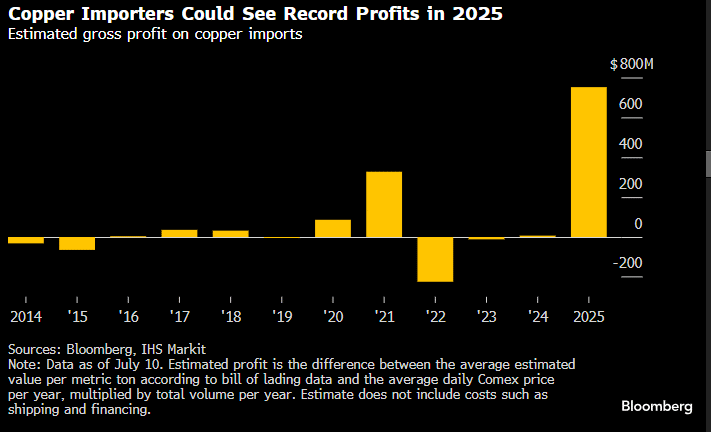

The immediate winners are clear: The commodity traders, miners and banks that have been able to ship copper to the US. Based on the simple math of the wide gap between prices in the US and the rest of the world, the flood of imports may have delivered a combined windfall of roughly $500 million, divided between the producers who’ve been able to sell their metal at high premiums, logistics companies being paid top dollar to fast-track shipments, and, the lion’s share to traders – Macquarie’s next report will be fascinating, their commodities desk is likely to have been sleep deprived of late!

We see calm returning to the copper market in the months ahead, with the recent dearth of supply outside the US likely supporting LME copper as imbalances are slowly addressed as the arbitrage trade is taken off the table courtesy of tariffs, with the US government taking over from traders in benefiting from the 50% tariff.

- With global electrification gathering momentum, we see demand driving prices higher over the coming years.