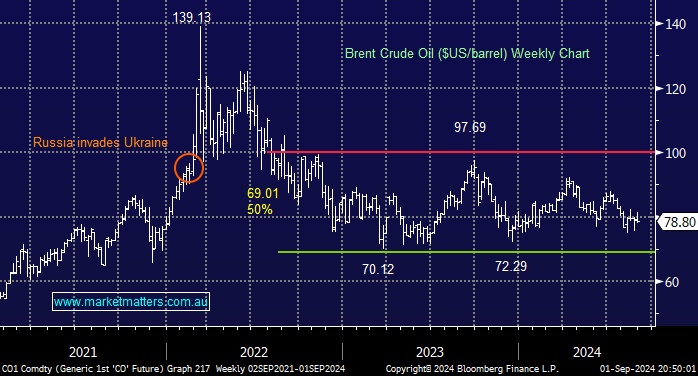

Last week, Libya confirmed significant disruptions in its oil output, and the Energy Information Administration (EIA) announced crude oil storage is at an eight-month low. Crude oil is theoretically enjoying tailwinds, with Middle East tensions remaining elevated. However, fears of a global economic slowdown continue to weigh heavily on oil prices, something equities are more relaxed about. At MM, we are never comfortable with a market that cannot rally on supportive news.

- We can see a retest of the $US70 area over the coming months as the weakening global economy weighs heavier than concerns around the Middle East supply.

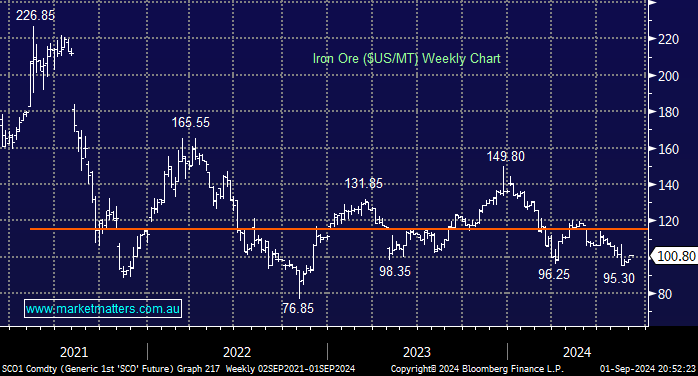

Iron ore has received considerable publicity over recent weeks, with lower prices weighing on heavyweights BHP & RIO and, by association, the ASX. However, as we all know, in the cyclical commodities market, opportunities present themselves when things look their worst, and things certainly looked bad for the bulk commodity in August. However, BHP’s CEO Mike Henry said he expects China’s property sector to rebound in the upcoming year due to favourable government policies – MM has been looking for this for a while but to no avail. While the BHP CEO has a clear vested interest in calling iron ore higher, we believe that Xi Jinping will get some traction sooner rather than later, which will have a sharp impact on the resources sector.

Interestingly, Alibaba (BABA US) has just secured the endorsement of China’s antitrust watchdog more than three years after a landmark probe into its online behaviour, suggesting Beijing may be softening towards commercial realities.

- We believe the current weakness in iron ore is reaching its nadir.