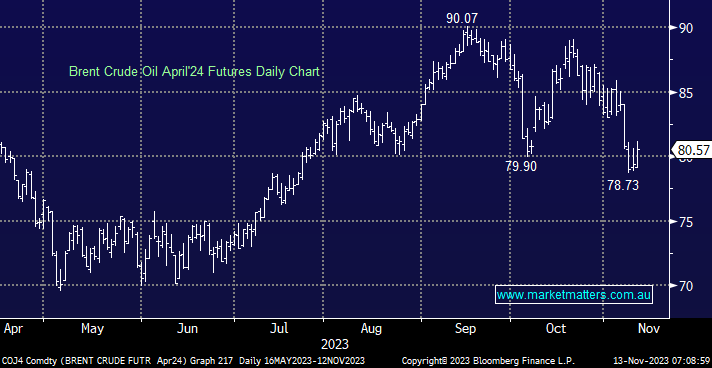

Crude oil made fresh 4-month lows last week even as uncertainties in the Middle East persist, i.e. the path of least resistance is down. As we’ve said previously, central banks don’t always get what they want, but this time, we feel they will, with lower oil prices helping reduce inflation into 2024 – good news for interest rate-sensitive sectors such as real estate.

- We can see April 24 Brent Crude Oil Futures trading below $US78, although we believe some consolidation is due.

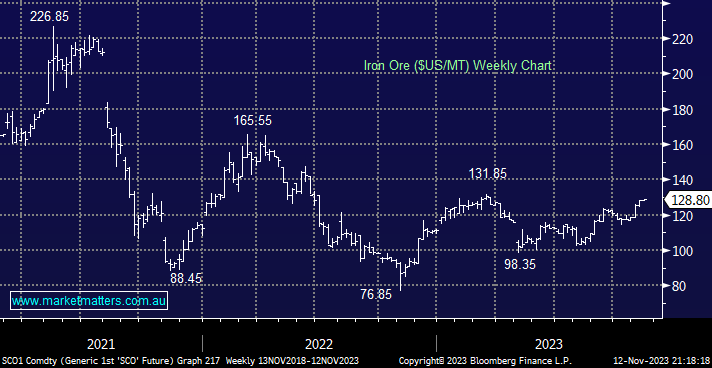

Iron ore keeps defying its sceptics/detractors and grinding higher, and in this case, we believe it’s a case of “don’t fight the tape”. Investors remain unconvinced that China can lift its struggling economy in the near future. Still, if Beijing manages to regain investor confidence, the bulk commodity will likely be trading 10-20% higher.

- We remain bullish toward iron ore, initially targeting fresh 2023 highs, but an eventual test of $US165 wouldn’t surprise, over 25% higher.