Brent crude oil retreated ~2% overnight on concerns about demand from China and the US. The commodity has now slipped 5% from last month’s high, but in the scheme of the rally since June, it is nothing major. However, if we do see increased fears of a global recession courtesy of a central bank’s hawkish policy, losses could easily be compounded. A strong $US and some profit-taking by short-term traders are likely to have added weight on the energy complex, taking crude down to a fresh 3-week low.

- We remain bullish towards crude oil, but the rally from its June lows is starting to mature.

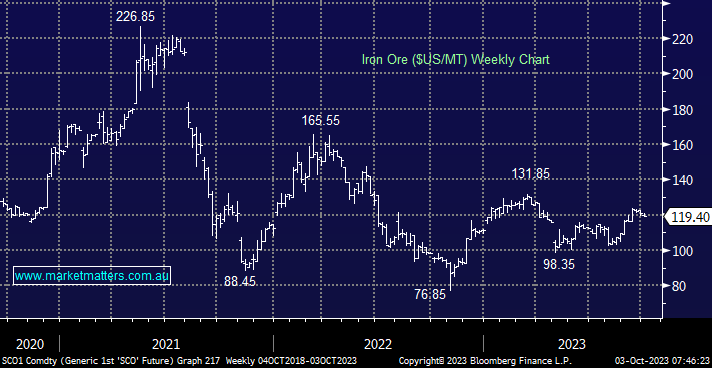

Iron ore also slipped -0.9% overnight as commodities buckled under the weight of a strong US dollar, plus resurfacing talk of economic woes in 2024 as markets contemplate the Fed et al. remaining heavy-handed towards interest rates.

- We are bullish toward China into 2024, and therefore remain constructive on Iron Ore, but any talk of a recession in 2024 will weigh on the bulk commodity and related stocks, e.g. BHP Group (BHP) fell 70c in the US last night.