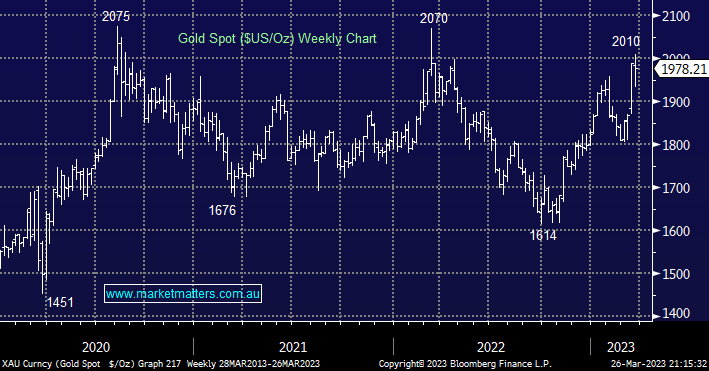

Surprisingly, even after the recent rally sent gold back toward its all-time high the speculative position in gold remains relatively low, which in our opinion underpins the bullish breakout potential for gold. Precious metals might need to consolidate as the banking crisis hopefully slowly abates but as the hiking cycle comes to its conclusion we believe it’s just a matter of time before gold breaks above $US2,100/Oz.

- Medium to longer term we remain very bullish towards precious metals and the Australian Gold Sector.

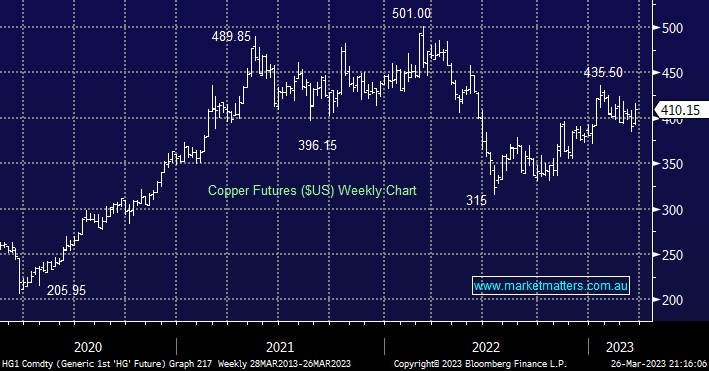

Dr Copper is painting a fascinating picture at present as bond markets tell us a recession is inevitable, yet copper, the usual bellwether of economic activity, remains firm and well above its 2022 low. The traditional supply and demand factors are supporting copper which benefits from the global commitment to a green transition, a long-term evolution that’s likely to be supportive of the red metal into any pullbacks.

- Our preferred scenario is copper eventually tests the $US5.00 area although it may not get there until 2024.