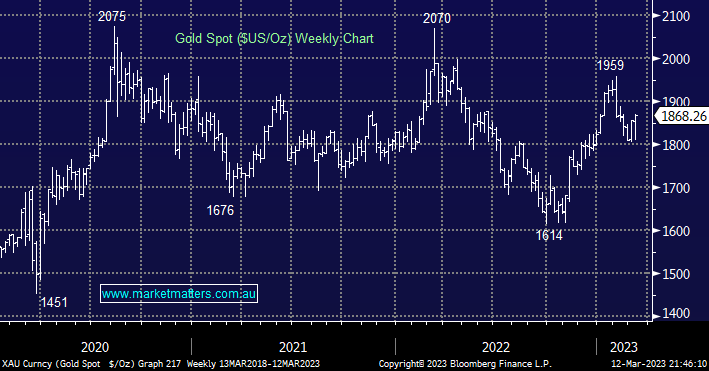

Gold bounced strongly last week as its safe haven status came to the fore plus the $US retreated as bond yields fell under the SVB influence. How things play out with Silicon Valley Bank is largely guesswork but we are encouraged by the noises from Janet Yellen et al, and we see stability returning sooner rather than later.

- Gold has spent many weeks over the last few years trading between $US1800 and 1900/Oz, at this stage, it feels like there’s more to follow.

- Medium to longer term we remain very bullish towards precious metals and the Australian Gold Sector.

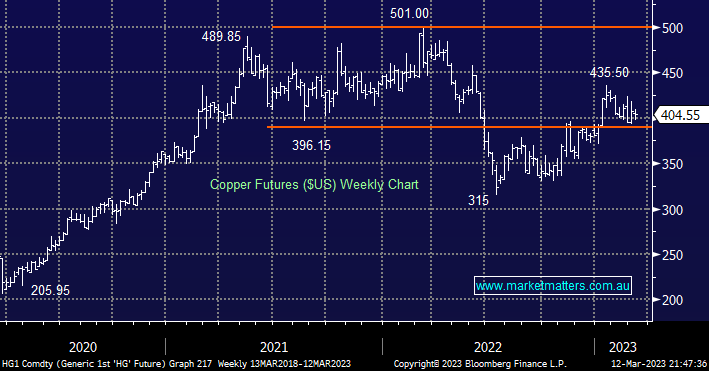

Dr. Copper doesn’t appear overly fazed about the largely expected recession over the coming 1-2 years which ties in with our bullish outlook over the medium term towards this industrial metal. We like the idea of buying dips under $US400 and any subsequent pullbacks in copper-facing stocks.

- Copper remains well supported even after China delivered a muted growth outlook and SVB worried investors on many levels.