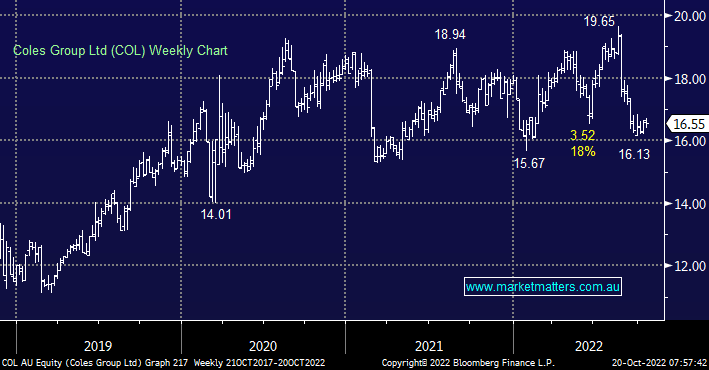

COL was the standout sector performer into August before plunging 18% following an average FY22 report and accompanying commentary – the numbers looked ok but no guidance was provided and the company discussed ongoing inflation pressures, primarily in the wages supply chain, weather impacts, and energy i.e. not surprisingly a very similar story to WOW. At the time we weren’t keen on COL ~$17.50 believing a test of $16 was a strong possibility, this has now unfolded and we’ve migrated to a more neutral stance.

- We expect food inflation to help COL move forward and trading on a 20.5x valuation has it looking ok, but not exciting to MM.